Best AI Stocks 2023 — How to Invest in Artificial Intelligence the Smart Way

Or: Hype vs. Opportunity - How to benefit from AI advancements without jumping overboard

Superlatives have been flying about (generative) artificial intelligence. ChatGPT is on everyone's lips these days.

Just, how mature is the technology already? Investors easily get burned by being too early.

Today, I will unpack how you can invest in AI without getting burned.

Step 1: Avoid FOMO and Stay Clear of the Hype

FOMO easily leads us into a trap:

Betting on winners too early,

putting everything on one card,

investing in hyped businesses, that cannot (yet) live up to the hype.

So don’t hit that “Buy now” button just yet.

After all, many trends have been claimed to revolutionize, save or destroy the world once and for all.

Remember blockchain, clubhouse, metaverse, autonomous driving, and hydrogen...? The list goes on. Well, is anyone still doing Club House events today?

I don't mean to discount these trends by any means. There are many promising opportunities among them, but they have yet to prove widespread and profitable real-world applications.

Many people believe, there is only one way to profit from new trends: Investing in the most hyped [insert trend of your choice] newcomers.

But: There is also another way to invest in AI. Less risky, yet profitable.

Here's how.🤖

Step 2: Invest in AI Indirectly by Picking Quality AI Profiteers

Artificial intelligence is not new. It has been used in all kinds of businesses. Successfully. For years.

That means you don’t need the newcomers just yet.

Instead of getting burned by betting on tomorrow's winners, pick today's champs: Companies that are already using, monetizing, and enabling Artificial Intelligence in a meaningful way.

Successful companies share these common traits:

Strong revenue growth and (trend to) profitability

Outstanding management and business model

A raging customer base

A powerful moat

Remember: You don’t need to buy the latest AI newcomer when you can invest in proven champions benefitting from AI.

Step 3: Optional: Once the Technology Matures, Shift into AI-native Companies

“We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.” - Roy Charles Amara

By investing in AI indirectly, we steer clear of the hype. However, once the hype is gone and AI companies have matured their business models, invest in the best AI-native businesses.

Until that time has come, here are 3 investment ideas to indirectly leverage AI for your portfolio in the meantime.

3 Artificial Intelligence Investment Ideas to Spice up Your Portfolio

NVDA, (21%) YoY

What they do

You probably think of NVIDIA in the context of gaming. After all, the company invented the GPU in 1999 and ignited the growth of the PC gaming market. The tech giant is also active in automotive, professional visualization, and cryptocurrency mining. But it can do much more than that:

NVIDIA is a full-stack computing company with highly scalable data centers.

Servers using their GPUs and infrastructure benefit from accelerated computing and can reduce deep learning training time from months to hours or even minutes.

This is where the AI magic happens: NVIDIA’s powerful GPUs and accelerated computing enable AI at scale.

And NVIDIA is seeing traction: "AI is at an inflection point, setting up for broad adoption reaching into every industry, from startups to major enterprises, we are seeing accelerated interest in the versatility and capabilities of generative AI.” Jensen Huang, Founder & CEO of NVIDIA

Market capitalization

With 517.19B in market cap, NVIDIA is a large-cap company.

(Trend to) profitability

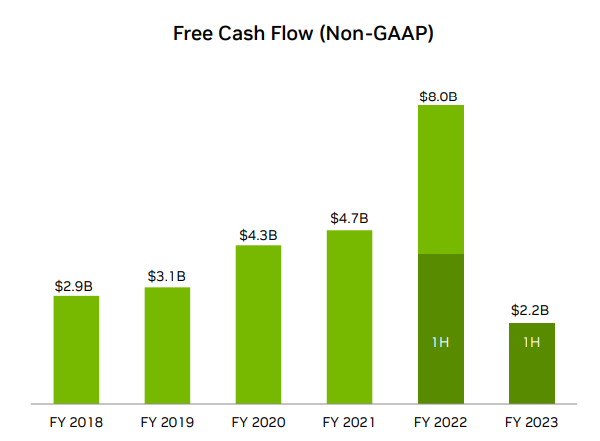

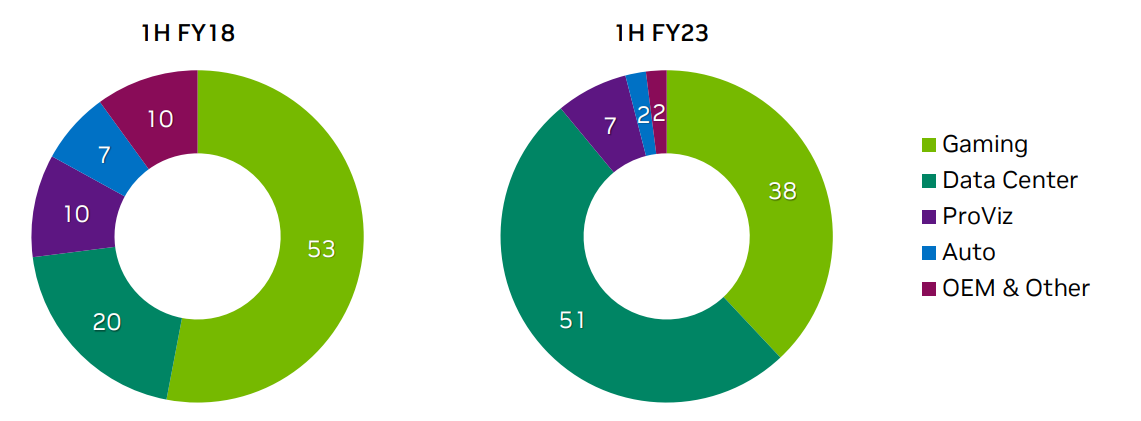

Last quarter, NVIDIA had a Free Cashflow of s $1.74B. Free Cashflow turned positive again after a negative -156M in the previous quarter. Generally, it deteriorated from the year before, which can be attributed to slowed-down revenue.

Revenue and growth

Speaking of revenue: In 2022, the tech giant took a hit in its growth due to a slowdown in gaming and cryptocurrency mining - both major use cases of their GPUs. That translated to negative -21% YoY growth in Q4 2022.

However, their (revenue) focus is increasingly shifting to their data centers and GPUs for AI enablement: You can see that the share of data centers increased significantly in the revenue mix. Their data center revenue also outperformed overall revenue and yielded 11%YoY in Q4, 2022.

Future outlook and my take

For the future, NVIDIA expects to have a 1 trillion market opportunity across its product suite. In combination with their increasing focus on data centers and emerging AI tailwinds, this becomes quite an attractive mix. For investors with a diversified portfolio, I consider NVIDIA a no-brainer.

SNOW, 67% YoY

What they do

Snowflake works with the very foundation for AI: all things data. In their Data Cloud, businesses can streamline the way they collect, process, and analyze their data. With diverse analytical workloads, Machine Learning workflows, and data processing for Python and SQL, Data Scientists can unlock the full potential of their data and scale their infrastructure.

Additionally, Snowflake enables application development, data sharing, and data engineering, and supports IT departments with data lakes & warehousing.

Market capitalization

With 49.552B in market cap, Snowflake already counts as a large-cap company, but is, by factor 10, smaller than NVIDIA.

(Trend to) profitability

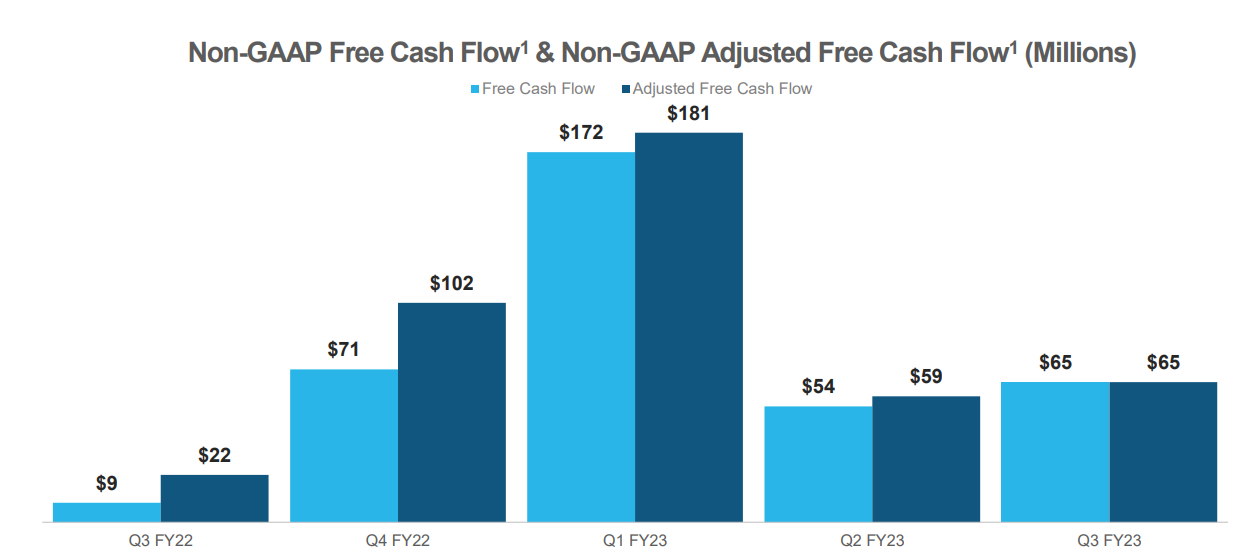

Last quarter, Snowflake had a Free Cashflow of 65M. The business has been Non-GAAP profitable for many quarters, despite taking a setback in mid-2023 due to workload optimizations it passed on to customers.

Revenue and growth

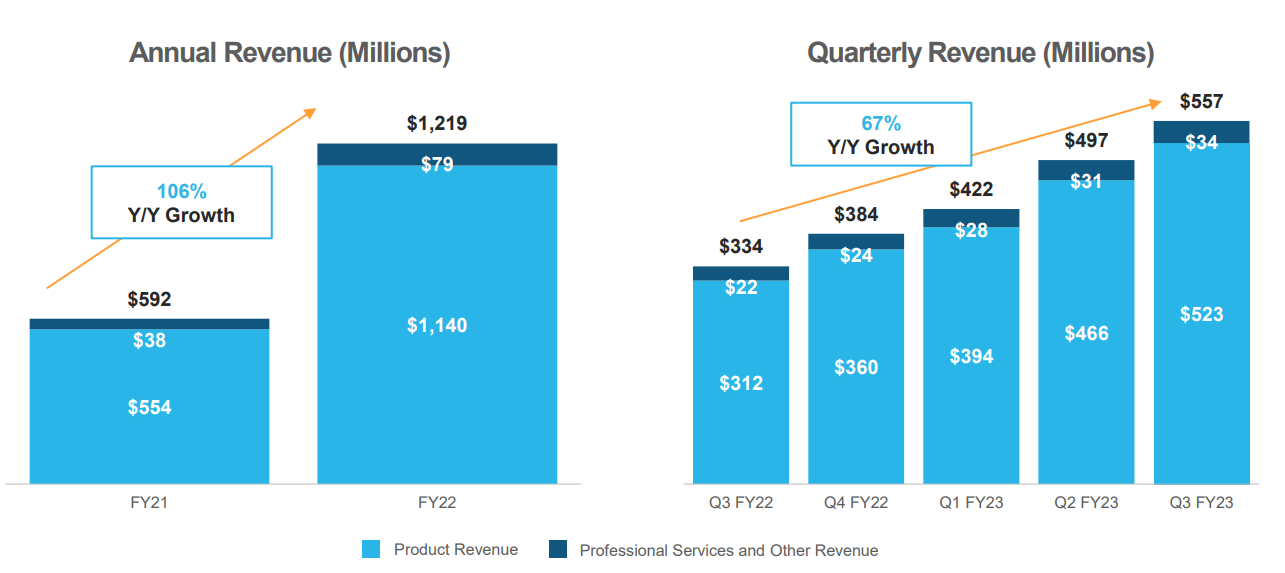

Snowflake has been growing fast and reliably since its IPO. Last quarter it managed to grow 67% YoY, despite challenging macro conditions affecting the consumption-based revenue model.

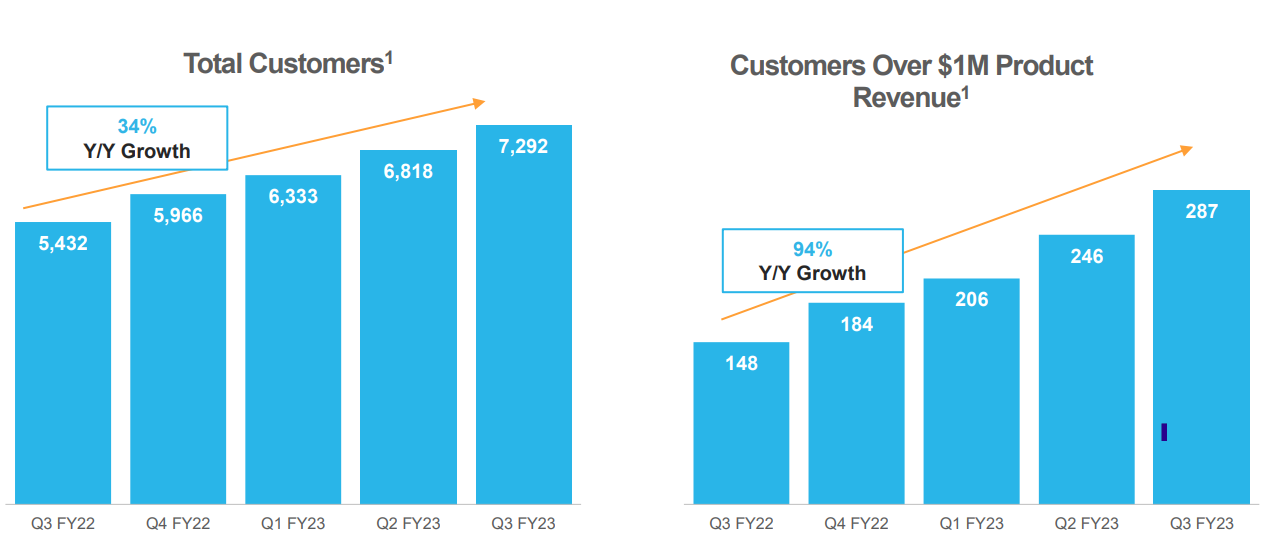

Their revenue growth is increasingly driven by large customer momentum. Very promising. In the graphic below you can see how large customers significantly outgrow total customers. By expanding the spending of its customers, Snowflake has significant potential to nurture them into large 1M+ customers. This thesis is also supported by their strong Dollar-Based Net Revenue Retention Rate of 165% last quarter.

Future Outlook and My Take

For 2026, Snowflake expects to have a $248B TAM for its Cloud Data Platform. While data processing per se may become a commodity, the company benefits largely from its constant innovations. For instance, Snowflake is building a powerful ecosystem and data-sharing network effects through its Data Marketplace. With its Powered By program, Snowflake allows companies to build their applications directly on Snowflake.

While cost optimizations might cause slower revenue growth this year, there is still a lot of potential for durable growth and expanding large customer spending.

For GARP investors (growth at a reasonable price), Snowflake might be still on the expansive end of the spectrum. As a high-growth investor, I prefer to focus on their strong performance so far.

Artificial Intelligence ETFs

A very simple and risk-reducing option for benefitting from a larger technological trend is a themed ETF. There are many ETF options bundling different types of AI-related stocks.

One example is the Xtrackers Artificial Intelligence and Big Data UCITS ETF 1C. It invests in 84 different stocks, including, Accenture, NVIDIA, Alphabet, Microsoft, and many others.

An ETF like this is perfect for anyone who wants to participate in the latest technological advances with minimal risk and minimal effort.

Of course, many high-growth companies use AI, too: DDOG, CRWD, and NET, just to name a few.

However, we want to keep things interesting and also look at some other companies from time to time.

TL;DR

There are many ways to invest in Artificial Intelligence in investing. Buying the hype might work in a few cases, but I prefer to benefit indirectly until the hype clears up.

You can do the same: Spice up your portfolio returns with awesome companies, but without getting burnt by extra risk.

In a nutshell, it goes like this:

Step #1: Stay clear of the hype

Step #2: Invest in companies that indirectly benefit from AI

Step #3: Once AI and its monetization mature, pick AI-native companies

Thank you as always for reading and Happy Investing! 💚

*All fundamental numbers are per quarter and sourced from the latest reported fiscal quarter. Of the presented companies, I own shares of SNOW. NVIDIA screenshots are from their previous quarter since their latest investor presentation is not available yet.

**Disclaimer: This text is for entertainment purposes only and does not represent any investment advice, stock buying or selling recommendation, or any other financial advice. Please see our disclaimer for more details.

***Please note: The text is based on the information available at the time. Investment decisions can change at any time based on new information.