CrowdStrike (CRWD) Q1'24 Earnings Recap

CrowdStrike is Turning On Efficiency Mode: Gaap-Profitability and Record Margins Against Weak ARR & RPO

CrowdStrike is gearing up its efficiency across margins and bottom line and reached GAAP profitability for the first time. It’s becoming a strong “core” holding that is still growing around 40% YoY. Strong, considering its large market cap of $37.78B and its continuous executions for several years now.

RPO and ARR were weak in contrast to their strong bottom line – the biggest disappointment for investors in this report.

Let’s Start With the Top Line

Q1 revenue growth was $692.6M, a robust 42% YoY increase. While sequential growth was 8.7%, down from the previous quarter, the company surpassed Q1 guidance and raised its full-year outlook. Q2's projected revenue is $727.4M, hinting at another sequential decline, typical for weaker Q2 and Q3 seasons. International markets outpaced overall growth, up 53% YoY.

Annual Recurring Revenue (ARR) rose 42% YoY, reaching $2.73B, but net new ARR was $174.2M, lower than the past 5 (!) quarters and decelerating sequentially. ARR outlook for the full year remains around 30% growth due to longer sales cycles, smaller deal sizes, and increased deal scrutiny.

On top of weak ARR, Revenue Per Order (RPO) declined YoY for the first time ever, now standing at $3,315B. Also impacted by businesses switching from multi-year to 1-year contracts. Makes sense, but meh.

Happier Results on the Bottom Line

While growth is hampering (but still, strong - don’t want to make it sound worse than it is), CrowdStrike really proves how it can increase its efficiencies. Showing investors record outcomes and beating expectations for Operating Income, Net Income, and Free Cash Flow.

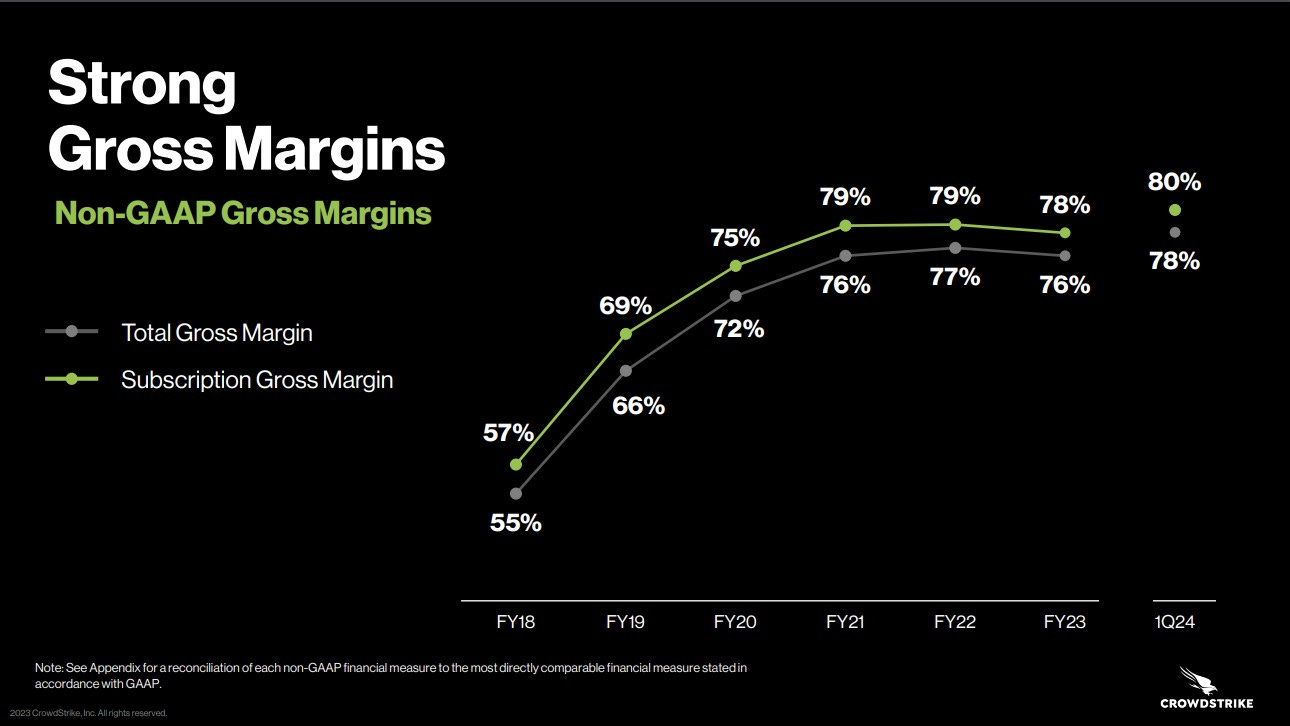

Margins improved across the board. Each margin gained around 30 bps – that’s really strong! For ex., the non-GAAP Subscription Margin surpassed 80+% for the first time - ever. Reason: data center and workload optimization.

Non-GAAP Operating Expenses are roughly in line with previous quarters (S&M as a share of revenue are higher than in previous Quarters, driven by the timing of marketing and in-person events, R&D and G&A are stable)

Operating & Free Cashflow was strong at 43% and 33% of revenues, respectively.

CrowdStrike also achieved record non-GAAP Net Income and GAAP profitability for the first time. However, this is not expected to be sustainable just yet, as it was mostly driven by adding less headcount in Q1.

EPS reached a record of $0.57 per share and CrowdStrike is on a mission (yes, to stop breaches), but also to control stock-based compensation, while retaining top talent.

It strives to keep dilution under 3% in the coming years. Good for shareholders, but also, controlling SBC is important on the way to sustainable GAAP profitability.

Turning to customer activity

So, how are customers doing? We don’t know, unfortunately, since CrwodStrike switched from a quarterly reporting of customer count to annual. This leaves us with retention and product adoption.

CrowdStrike’s Net Retention Rate continues to decrease and now sits at 120+%, down from 125% last Q and 126% a year ago. I don’t like it, but it’s a common theme in this uncertain macro environment and not specific to CrowdStrike.

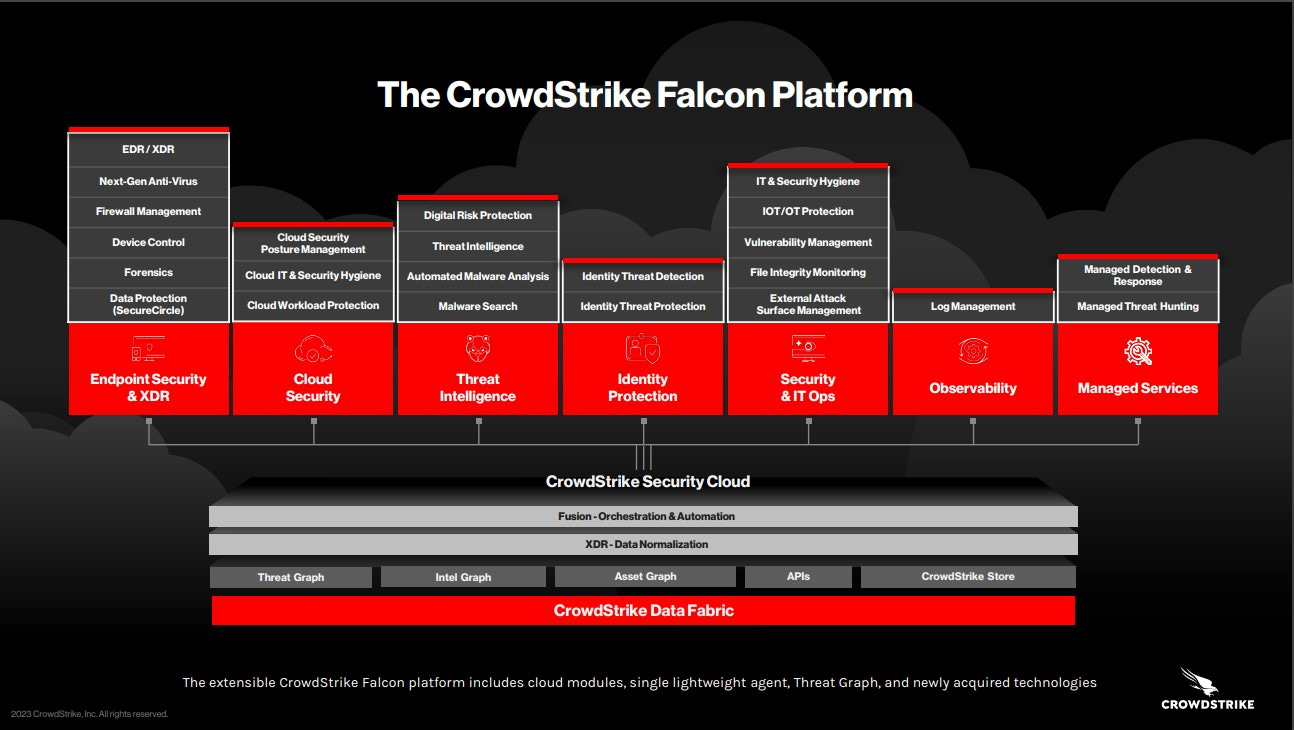

Product module adoption (vendor consolidation): This metric is critical for me because it helps me gauge product adoption rate and underscores CrowdStrike’s claim of consolidating several other vendors on its Falcon platform (or not). Fortunately, this looks good: Adoption of 5+ modules remains stable, and adoptions of 6+ and 7+ modules increased by 1 bps each.

My Thoughts

The cyber security market is fragmented and dynamic. So far, CrowdStrike is well positioned and a popular choice for CISOs, maintaining strong win rates, and driving vendor consolidation.

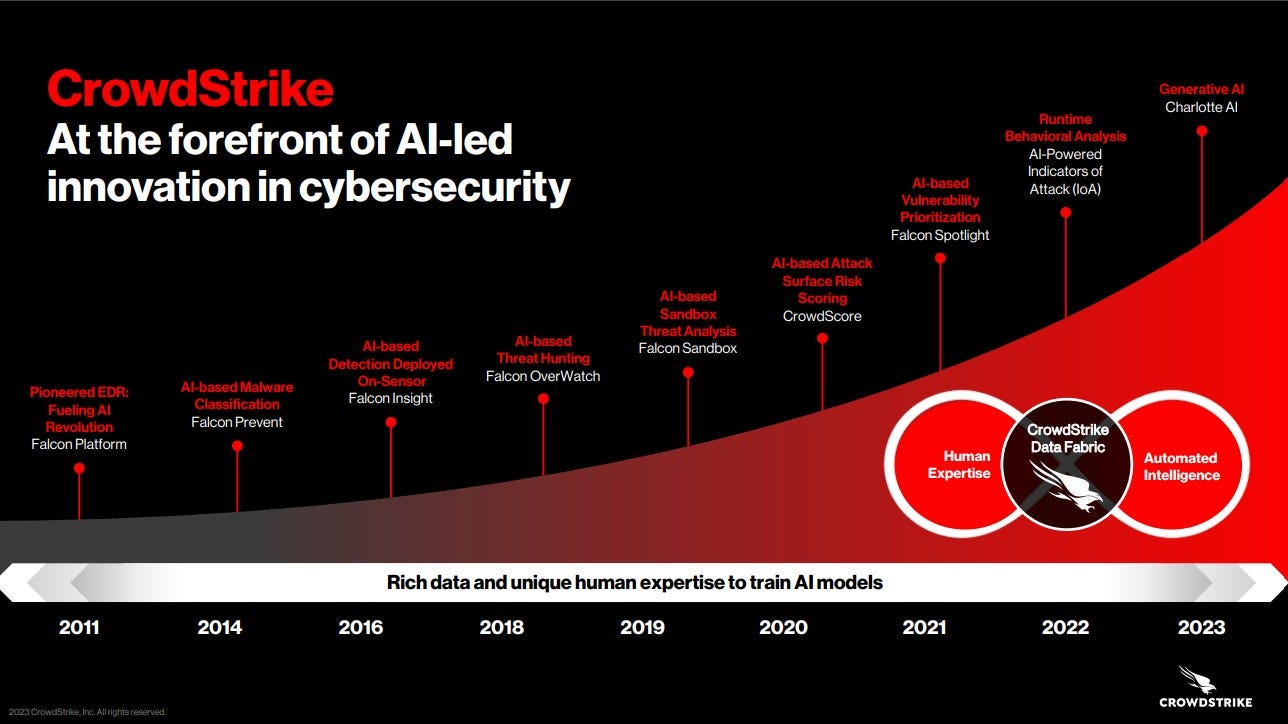

It owns years’ worth of high-quality data which it can use to train LLM models (data moat), helping its users interact with Charlotte AI, a newly launched assistant. This makes it easier for novice analysts to become power users - an important advantage in a job area that is lacking enough security staff.

Other notable highlights include CrowdStrike and AWS working together to develop new Generative AI applications, as well as CrowdStrike achieving Impact Level 5 Provisional Authorization from the Department of Defense, which should help with public deals.

My Investing Decision

I hold a 9 - 10% position in CrowdStrike and view it as a core holding in a growth-oriented portfolio. It’s maturing in terms of profitability but still has high growth and a long runway. Why? Room to grow in endpoints by replacing legacy solutions, emerging products like identity and incident response have strong traction, and international markets are growing faster but are not very penetrated yet.

⟶ I plan to maintain my position size for now.

Thank you for reading and enjoy your Sunday! 😊

Disclaimer: This text is for entertainment purposes only and does not represent any investment advice, stock buying or selling recommendation, or any other financial advice. So please always do your own due diligence and make your own decisions. See our disclaimer for more details.