The past few weeks have certainly been eventful: cloud businesses reporting, mostly better than expected.🎉

And finally some green numbers, with my portfolio up 14.5% YTD. I also plan to provide more regular updates on Twitter. I’d love to connect with you over there!

Fear > Conviction?

Believing in a company is easy in good times. It’s in tough times that our conviction is put to the test. I noticed many growth investors change their investment strategy lately.

They are now:

Starting to trade

Selling their SaaS stocks

Shifting to GAAP-profitable stocks only

Concentrating their portfolio further to only 3-ish stocks

18 months of draw-downs take their toll on conviction. I’m also not immune - after feeling chilled for 17 months, I got really anxious just before BILL 0.00%↑ reported. Another -25% draw-down after earnings? Ugh. I considered reducing my position pre-earnings.

Moritz questioned why I hadn't already trimmed my position much earlier if my conviction was that low. This made me reconsider:

Did I still believe in the long-term prospects of bill? Yes.

Am I a trader or a long-term investor? Long-term investor.

Are the fundamentals on track? After analyzing my spreadsheet: Yes.

I got my answer and decided to maintain my position based on conviction. Even got some positive post-earnings price movement, up +30%+, that I would have missed otherwise.

Takeaways:

Focus on what you can control

Have an investing buddy

Follow the numbers

Conviction > fear

GAAP vs. Non-GAAP

Conviction is crucial, but it’s also important to be open-minded and challenge ourselves. After all:

Making Money > Being Right

In the spirit of challenging myself and witnessing so many investors shifting to GAAP-profitable stocks only, I wanted to circle back to GAAP vs. Non-GAAP profitably.

Refresher: What is GAAP & Non-GAAP?

GAAP,

or Generally Accepted Accounting Principles, is a standardized set of accounting rules that every public company in the US must follow. I think of it as the “financial/accounting theory”.

Non-GAAP,

on the other hand, allows companies to present supplementary metrics that deviate from GAAP principles, providing flexibility to highlight unique aspects of their business. Non-GAAP is better to gauge the actual performance of a business’s operations. In non-GAAP, companies can, for instance, adjust for:

Stock-based compensation (SBC)

Acquired intangibles write-off

Restructuring costs

Non-GAAP reporting is very common among fast-growing tech companies that often use significant amounts of SBC to compensate their employees, making them a "Co-Owner", and aligning their interests with what's best for the business.

These stock options don’t present actual cash outflow. Yet in GAAP reporting, they are deducted as expenses, distorting the picture of a company’s performance. For disclosure: Main disadvantage of SBC for investors is dilution.

GAAP vs. Non-GAAP profitability

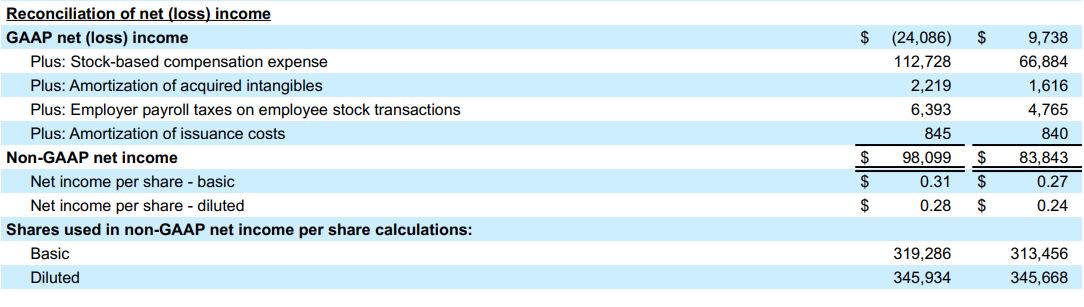

Now, let’s look at GAAP vs.non-GAAP profitability on the living subject - the latest earnings report of DDOG 0.00%↑

GAAP net income is modified by adding back the amount of SBC and SBC-tax, as well as cash-irrelevant amortization effects. Without these non-cash-related expenses, it’s easier to actually see how Datadog’s business is doing from an operations perspective. And this is what I personally care about.

However, I do track GAAP metrics in my spreadsheets as well, and like to refer to them from time to time to sanity-check the non-GAAP reports. Either way, if I want to see how the business performance is doing from an operational point of view, I prefer to follow the non-GAAP numbers.

Note: This article does not aim to fully explain every aspect of GAAP and Non-GAAP. However, if you want to learn more about it, check out this overview on GAAP vs. non-GAAP.

What’s The Takeaway?

GAAP profitability often indicates that a company has more cash because GAAP cash should exceed expenses such as SBC and write-offs. So far, so good.

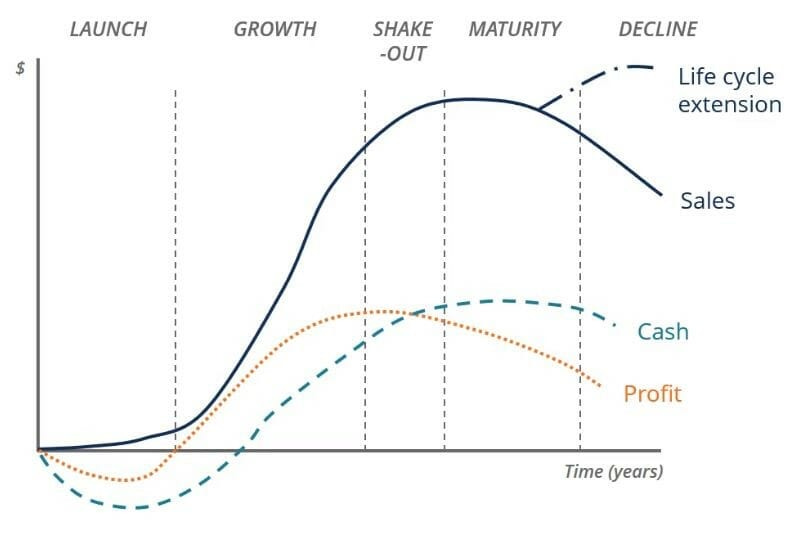

However, companies often follow certain maturity stages. From being a highly unprofitable, but very fast-growing business in the early stages, all the way to potentially becoming a behemoth.

Here’s a great illustration of the business lifecycle. I invest in companies that are in the growth section (high growth, not as much cash yet)

Since I want to catch that part of the S-curve, I pay attention to the company’s (trend to) profitability but don’t exclude great GAAP-unprofitable businesses from my portfolio.

While Mr. Market likely prefers GAAP-profitable stocks in the short term, I have conviction in my portfolio as is and try to look beyond short-term market reaction.

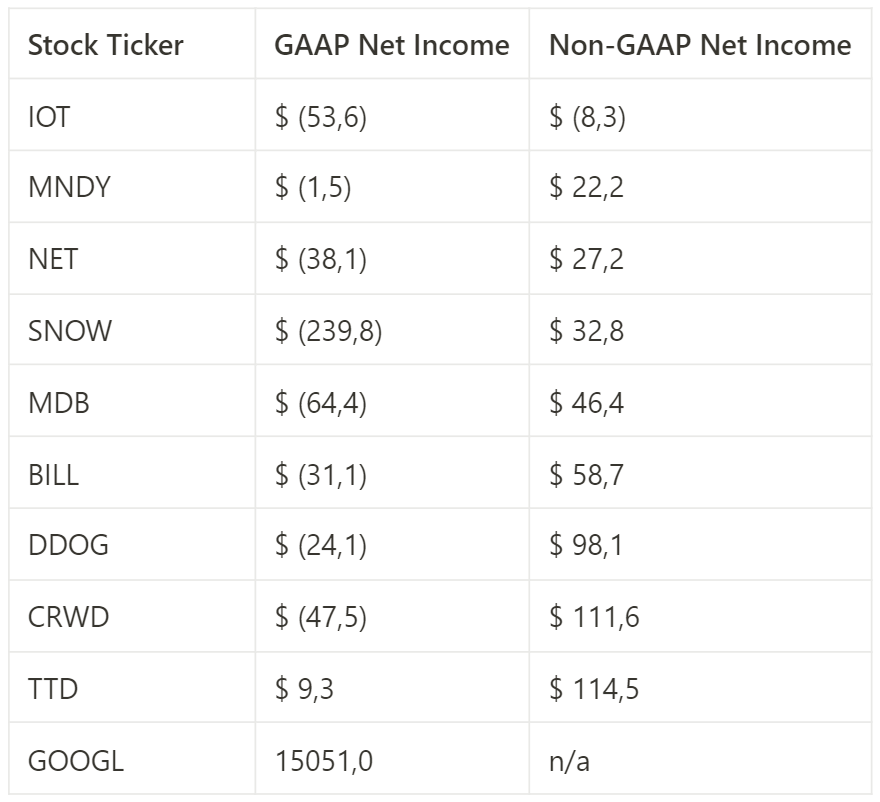

GAAP vs. Non-GAAP Net Income of My Holdings

Closing Thoughts

It's not short-term stock prices that count, but long-term conviction.

TL;DR

Find and stick to an investing style that suits you

Stay open-minded and challenge yourself

Focus on what you can control

Making money > being right

Have an investing buddy

Follow the numbers

Conviction > fear

Thanks for reading and I hope you enjoyed today’s update. I’d love to hear your feedback so that I can write more relevant content for you. Thanks! 💛

Next up: Earning Recaps. Stay tuned!

*This text is for entertainment purposes only and does not represent any investment advice, stock buying or selling recommendation, or any other financial advice. So please always do your own due diligence and make your own decisions. See our disclaimer for more details.