Hey, fellow happy investor 👋

Let’s dive right in.

My Portfolio

The purpose of my monthly portfolio review is to help you understand my investment philosophy, view my current investments, and facilitate mutual learning. I hope this review is helpful to you!

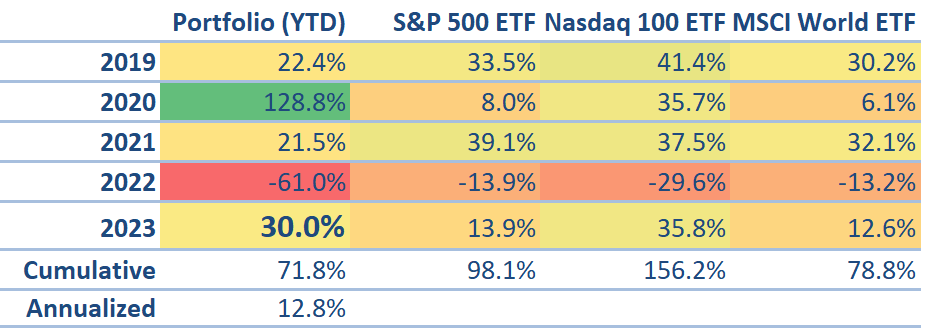

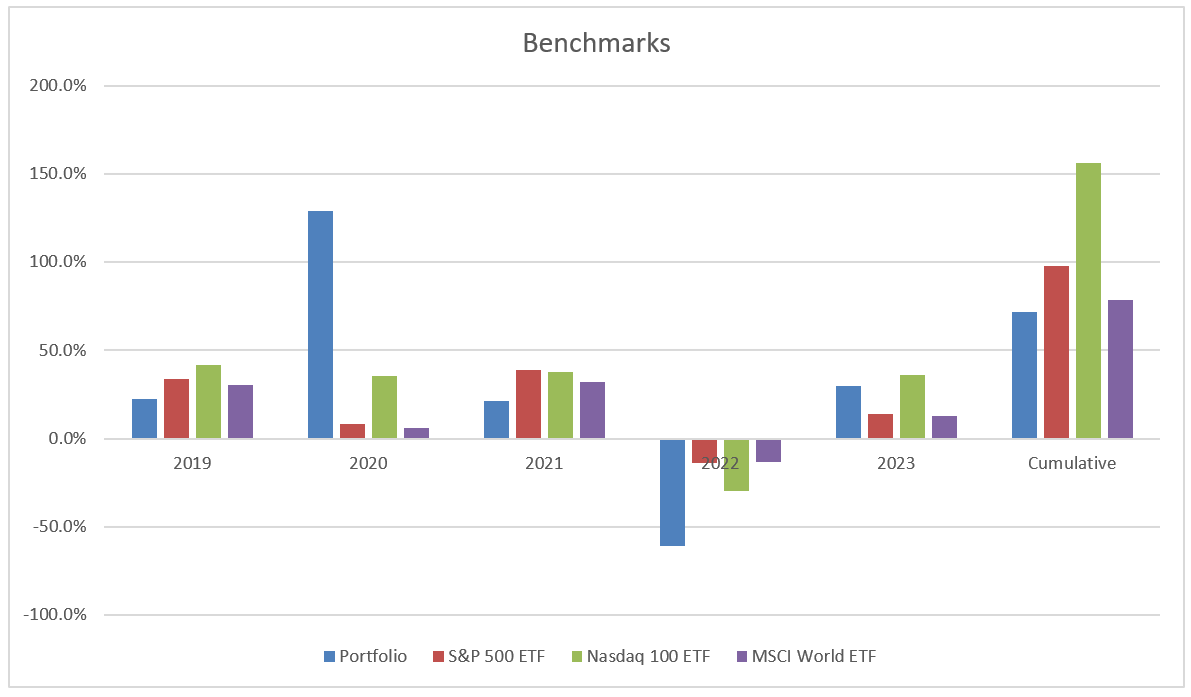

Portfolio performance compared to market

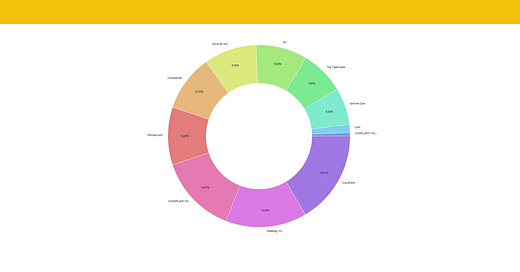

Portfolio allocations

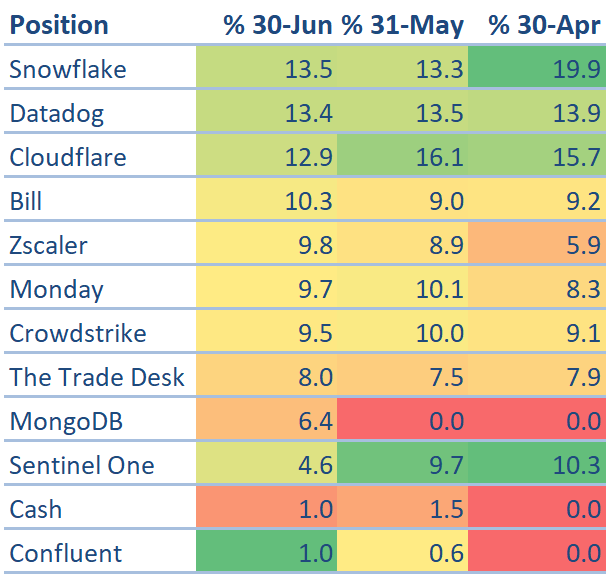

Recent changes to the portfolio

This month was more active than usual for me, mainly because I opened a new position in MongoDB and needed funds for that. Additionally, you may notice a small cash position (1%), which I plan to reduce to 0% soon since I typically don’t hold any cash.

Trimmed

Cloudflare - NET 0.00%↑

Once the stock reached $70, I decided to reduce my already large position so that I could invest more in MDB.Sentinel One - S 0.00%↑

After the stock went up to $16, I reduced my position in S by about 30% to allocate more funds to MDB.Snowflake - SNOW 0.00%↑

Like NET, SNOW's stock price continued to rise ($170), and they wanted to add more to MDB.Datadog - DDOG 0.00%↑

Like NET, DDOG’s stock price continued to rise ($100), and they wanted to add more to MDB.

Added

Confluent - CFLT 0.00%↑

My plan is to increase CFLT to around 5% in the near term, which is why I am adding to it on a monthly basis.

New position

MongoDB - MDB 0.00%↑

I finally reopened a position after monitoring MDB for the past few years due to better-than-expected earnings and a positive outlook.

Company updates

Note: To keep it concise, only companies with noteworthy updates might be included. Absolute numbers relate to last quarter's earnings release. Metrics are adjusted values (Non-GAAP).

Crowdstrike - CRWD 0.00%↑

What they do: Leading cybersecurity firm with a "mission to protect customers from breaches”

Type of revenue: Seat-based (Endpoints)

Cash: $2.9B

TTM revenue: $2,446M

Market cap: $35B vs last month's $38B

Key Highlights

Revenue

Crowdstrike's Q2 2023 revenue was $692.6M, 42% year-over-year, and 8.7% quarter-over-quarter beating expectations, but decelerating sequentially.

Net new ARR was $174.24M, negatively surprising the market, but management is confident about acceleration for the back half of the year due to momentum with large customers, record Q2 pipeline, and partnerships.

The remaining performance obligations were $3,315M, negative sequentially for the first time. International revenue is slowly gaining share and growing faster than total revenue at 53% year-over-year.

Outlook

The Q2 revenue guide is $727.4M, suggesting 7.3% quarter-over-quarter and 38.8% year-over-year growth if they keep beating their guide.

The FY2024 revenue guide was raised by 2% to $3,036.7M, with a potential 40% year-over-year growth if they keep raising their guide and deliver a beat in Q4.

The Q2 operating income guide is $123.8M, and the FY2024 operating income guide was raised by 1% to $526.2M. Also, the FY2024 EPS guide has been raised to $2.43 from $2.39.

Cash Flow & Profitability

Subscription gross margin increased to 80% due to investments in data center and workload optimization.

Operating income was $110M (16% of revenue), up from last year's $83M. Net income was $136M (19.7% of revenue), up from $75M. Earnings per share increased to $0.57 from $0.31.

Operating cash flow increased to $301M (43.4% of revenue) and nearly half of the revenue generated cash flow. Free cash flow increased to $227M (32.8% of revenue).

Next quarter, we should expect lower cash flow due to the usual seasonality in Q2 and this year management expects to see more pronounced seasonality but maintains the target of achieving 30% free cash flow margin for the fiscal year.

Crowdstrike reached GAAP profitability for the first time in its history with $0.5M net income, compared to a loss of $31.5M the previous year. The biggest factor for this achievement was the modest growth in stock-based compensation.

Customers

Unfortunately, we cannot see the quarterly development of customer growth since Crowdstrike is moving to annual reporting for new logo metrics.

The dollar-based net retention rate was 120%, down from 125%.

Customers using 5+ modules was 62% (stable), 6+ modules were 40% (up from 39%), and 7+ modules was 23% (up from 22%), indicating vendor consolidation and customer’s wanting more of Crowdstrike.

The gross retention rate remained high and best-in-class.

Notable Developments

Multiple future growth drivers have been mentioned:

First, a compelling partnership with AWS to develop powerful new Generative AI applications that help customers accelerate their cloud, security and AI journeys.

Second, the Impact Level 5 Provisional Authorization from the Department of Defense to sell more products into the public sector.

Third, the sustainable advantage as three mega-trends continue to unfold, AI, consolidation, and cloud:

AI

CrowdStrike believes that large language models (LLMs) are only as good as the data on which they are trained, and their unique dataset spanning petabytes and capturing trillions of new events daily from their global fleet of sensors, combined with over 10 years of attack data and threat graph, creates a sustainable data advantage yielding better models, automation, and outcomes in the rapidly growing adoption of generative AI within cyber security.

Moreover, Crowdstrike anticipates that the utilization of LLMs will decrease the difficulty for malicious actors to generate advanced cyber-attacks. This, in turn, will be a catalyst for demand for contemporary cybersecurity technologies such as Falcon.

Lastly, Crowdstrike has introduced Charlotte AI, a generative AI security analyst that uses high-fidelity security data and is continuously improved through human feedback. Charlotte AI aims to provide faster results, better security outcomes, and lower costs, and will benefit from a continuous human feedback loop with CrowdStrike's OverWatch, Falcon Complete, and Intel teams.

Consolidation

The current macro environment has increased the need for customers to reduce vendor sprawl, agents, and costs, while protecting their businesses with a best-in-SaaS platform. Falcon offers over 200% ROI for enterprise customers, making CrowdStrike a popular choice for businesses looking to protect and drive efficiencies.

Cloud

The exploitation of cloud services has increased by 95% YoY, and the number of threat actors operating in cloud environments has increased by 288%. Securing cloud assets is crucial and will continue to grow in importance. Crowdstrike is well-positioned to meet this need.

Competition

CrowdStrike's competitive environment has remained unchanged since April, with enterprise customers choosing CrowdStrike over Microsoft 8 out of 10 times during testing and strong win rates across all competitors in the quarter.

Dilution & Valuation

Dilution increased by 4% year-over-year to 241M diluted shares outstanding. Management expects 242M in Q2, which continues the upward trend. However, for a healthier development for shareholders, it would be ideal to see this increase go back to around 2% year-over-year. Management has mentioned that they aim to keep it under 3% this year.

Crowdstrike is richly valued at an EV/S of 11, but still below the average (13) of the top 10 SaaS company multiples in Jamin Balls' valuation list for high-growth stocks.

Investment Decision

It’s good to see that my hypothesis from last quarter seems to be holding up so far, with sequential revenue growing at 8.7%.

From my March 2023 summary:

Here is my thesis: Crowdstrike has a seat-based subscription model. I interpret the stabilization of sequential metrics as a slowdown in layoffs, which is good for seat-based subscription model businesses like Crowdstrike, indicating the endpoint market is not saturated and the market has stabilized.

However, this does not mean we should expect further quarter over quarter acceleration, as businesses are not currently hiring more. So, I assume we'll see minimal beats for another 1 to 2 quarters and possibly acceleration again in Q3.

I believe assuming Q1 revenue of $690M, 8.3% quarter over quarter growth with a 1.7% beat is realistic and "prudent." I try to make conservative assumptions (and if these sound too conservative, it's time to trim) - the last thing I want is a negative surprise every quarter.

I also assume Crowdstrike will achieve around 40% revenue year over year at the end of FY2024 (with some luck), more would be very optimistic.

While the actual top-line results were mixed due to weakness in RPO and net new ARR, the outlook appears positive. Management's confident tone and multiple raises from revenue to profitability guides support this view. If the macro environment starts to improve, we might even see 40% year-over-year revenue growth.

The profitability across the board is great, especially considering the impressive operating cash flow margin of 43%! Achieving GAAP profitability for the first time is a significant accomplishment.

The decline in DBNRR was expected due to macroeconomic factors negatively impacting sales. Despite this, it's great to see customers still buying more modules.

The partnership with AWS, the Impact Level 5 Provisional Authorization, and positioning for megatrends (AI, Consolidation, and Cloud) with no change in competition indicates sustainable growth ahead.

Dilution (4% YoY) is higher than I prefer, but management is keeping an eye on it. The valuation at an EV/S of 11 makes sense. Given its strong performance, tailwinds, and runway ahead, I believe the stock is reasonably valued.

As mentioned in my previous summary, I took advantage of the 10% drop in after-hours trading to increase my allocation from 9% to 10%. I have no plans to make any further changes for now.

Note: If you haven't read my coverage on Crowdstrike's competitor, Sentinel One, yet, check it out here:

Zscaler - ZS 0.00%↑

What they do: Cybersecurity firm that provides services secure user-to-app, app-to-app, and machine-to-machine communications over any network and any location

Type of revenue: Subscription-based

Cash: $1.97B

TTM revenue: $1,480M

Market cap: $21B vs last month’s $20B

Key Highlights

Revenue

Zscaler's revenue was $418.8M, a 46% YoY increase and an 8% QoQ increase. This met the positive preliminary guidance announced a month ahead of earnings.

Calculated billings were $482.3M, a 39.5% YoY increase and a -2.3% QoQ decrease. This was better than expected and an acceleration from last quarter.

Remaining performance obligations were $3,023M, up 7.6% sequentially, indicating that customers are committing to more future spend.

Management's ability to execute was aided by their well-performing sales organization and good product. Customers recognized the ROI by simplifying their network.

10 out of 13 analysts congratulated management on the impressive results.

My take: Zscaler continues to deliver. Their strategy of partnering with CXOs early on to create CFO-ready business cases appears to be effective.

Outlook

Zscaler's Q4 guide suggests 7% QoQ and 41% YoY growth if they exceed historical guidance.

For the full year, the revenue guide was raised by 2% to $1,593M, up 46% YoY, calculated billings guide was raised by 1.7% to $1,978M, and the operating income guide was slightly raised to $225M.

My take: Zscaler raised its full-year guidance for all metrics, indicating promising times ahead.

Cash Flow & Profitability

Zscaler achieved a gross margin exceeding 80% for the 11th consecutive quarter, with operating income at $63.9M (15.3% of revenue), net income at $74.6M (17.8% of revenue). Operating cash flow was $108.5M (25.9% of revenue), and free cash flow was $73.9M (17.6% of revenue).

Compared to patterns in previous years, S&M expenses have been cut down the most: $185M, which is 44.1% of revenue. However, there are no concerns here.

My take: The overall profitability remains excellent, with healthy cash flow margins ranging around 20%.

Customers

Zscaler added 95 customers spending more than $100k ARR, 22 customers spending more than $1M ARR, and 5 customers spending more than $5M ARR. Customer growth for the $100k ARR and $1M ARR cohort is decelerating sequentially due to larger deals take longer to close as customers introduce more checks and reviews.

The company serves eight of the world's largest financial services and diversified insurance companies, outside of China. They also have 40% of the Fortune 500 and 30% of the Global 2000 as customers.

Approximately 60% of new business comes from existing customers, who are spending more: The Dollar-based Net Retention Rate has remained at 125%+, but the company's success in selling bigger bundles, multiple pillars, and faster upsells within a year may reduce the rate in the future.

The Net Promoter Score of over 70 is a testament to Zscaler’s strong relationship with customers and in Gartner's peer insight rating, which is a customer survey done by Gartner, Zscaler is the only MQ leader who is in number one in all eight Gartner's category.

As stated in their earnings call, the focus is on ARR over having a large number of customers. Management still sees a vast upside in their customer base. After understanding this, I’m a bit less worried about the lower customer growth, which I expect to pick up again at some point.

Why it makes sense to focus on existing customers:

Zscaler has a 6x upsell opportunity with its existing customer base for protecting their users.

Management states, when it comes to cyber companies they’re probably the only company that delivers significant ROI, because they eliminate a bunch of point products.

They see customers buy ZIA, ZPS and ZDX - solutions they offer - for every employee happening more-and-more, because customers are seeing the value by being able to remove a bunch of point products and show ROI and that actually gives them more incentive to buy more.

Here's a recent example:

A fast-growing global bank in the APJ region upgraded to Zscaler for Users bundle, which supports 150,000 users, after deploying ZIA last year. This upgrade significantly reduces the time it takes to open new branches by 50% and eliminates the need for firewalls and MPLS network services.

Zscaler is now a strategic partner for this customer, as they continue to expand their footprint and transform into a cloud-centric organization. The customer stated that it was the first time they had seen a security vendor that understood their business needs and aligned its solution to address them.

With this latest purchase, the customer's ARR has surpassed $10 million. This is also an example of the geographic diversity of Zscaler's business outside the U.S.

My take: Zscaler primarily focuses on large enterprises, but currently, it takes more time to close deals, which slows down customer growth. While this is acceptable, an acceleration in sequential growth is expected next year.

On the other hand, Zscaler's focus on its existing customers makes sense due to the 6x upsell opportunity.

Notable Developments

Using AI, Zscaler has the opportunity to predict most of today's ransomware and other sophisticated attacks on their customers before they happen. And management plans to launch a number of innovations around AI.

That being said, Zscaler has already started integrating ChatGPT with policy-based access controls to ensure safe use of AI applications for their customers. If employees submit sensitive data to ChatGPT or similar applications, our DLP technology will detect and block it.

Zscaler's CEO, Jay Chaudhry, commented on his expectation that AI/ML will expand Zscaler's TAM (total addressable market).

My take: Exciting insights into how Zscaler incorporates AI and how it might become a significant advantage in the future can mean only additional fuel for sustainable growth ahead.

My Investment Decision

Zscaler continues to perform well, thanks to its strategy of partnering with CXOs early on to create CFO-ready business cases. This approach appears to be effective, as indicated by Zscaler's raised full-year guidance for all metrics.

The company's overall profitability remains excellent, with healthy cash flow margins averaging around 20%. Although Zscaler primarily focuses on large enterprises, it takes more time to close deals, which slows down customer growth. However, an acceleration in sequential growth is expected next year.

On the other hand, Zscaler's focus on its existing customers makes sense due to the 6x upsell opportunity. AI may become a significant advantage in the future, which bodes well for the company's continued success.

Zscaler's forward EV/S (enterprise value to sales) ratio is 13, which is slightly below the average of the top 10 SaaS company multiples in Jamin Balls' valuation list for high-growth stocks. Although Zscaler's valuation is stretched, it appears cheaper than NET, which has an EV/S ratio of 16.

It's important to note that while I do consider valuation as one factor for investment decisions, it's not my main consideration.

As I outlined in my previous portfolio summary, I added funds in small increments both before and after the positive preliminary guide with a target allocation of 10%.

Last month, I based my reasoning on the ongoing decline in the stock price. At that time, the valuation had reached a forward EV/S of 8.2, which I considered to be undervalued.

I did not change my already large position in June and plan to hold it for now.

MongoDB - MDB 0.00%↑

What they do: Provides a scalable and flexible NoSQL database for storing structured and unstructured data.

Type of revenue:

Consumption-based

Cash: $1.9B

TTM revenue: $1367M

Market cap: $29B

Coming soon: I’m planning to publish my review on MongoDB earnings in my next portfolio summary.

Confluent - CFLT 0.00%↑

What they do: Provides a platform for managing and processing streaming data.

Type of revenue: Consumption-based

Cash: $1.85B

TTM revenue: $634M

Market cap: $10.5B vs last month’s $9B

Coming soon: I’m planning to publish my review on Confluent next week. If you cannot wait, check out my TL;DR version in this Twitter thread.

Already covered

Check out the most recent reviews for my other positions here:

My Watchlist

DUOL 0.00%↑, OKTA 0.00%↑, IOT 0.00%↑, GTLB 0.00%↑, NVDA 0.00%↑

Closing Thoughts

Keeping it short this month. Just one thing:

Starting to write a monthly portfolio review was a game-changer for me.

Why:

It allows me to track performance regularly.

I can dive deep into each company.

It boosts my confidence, even in tough times.

I encourage you to start your own review.

And don't be afraid to share it publicly. More puzzle pieces mean better decisions for all of us!

Thank you for reading and Happy Investing, everyone!

PS - For more frequent updates, I'd be happy to connect with you on Twitter: @MoritzMDrews

Disclaimer: This portfolio summary is for informational purposes only and does not constitute investment advice. Everything expressed here is solely my personal opinion. As I am not a professional, please do not blindly follow my perspectives as they could lead to incorrect conclusions.

SNOW 0.00%↑ DDOG 0.00%↑ NET 0.00%↑ BILL 0.00%↑ ZS 0.00%↑ MNDY 0.00%↑ CRWD 0.00%↑ TTD 0.00%↑ MDB 0.00%↑ S 0.00%↑ CFLT 0.00%↑