Samsara (IOT) Q1'24: Firing From All Cylinders

Up +119% YTD. Growing Revenue +43% YoY. Record Large Customer Growth

What a YTD performance.

Is it the “AI-powered” platform?

Or the promising stock ticker IOT 0.00%↑?

Probably. But mainly: Delivering a strong quarter.

What Does Samsara Do?

Samsara provides AI-powered software and gadgets that help companies with physical operations (mostly trucks) improve their operations efficiency, safety, and environmental and social impact.

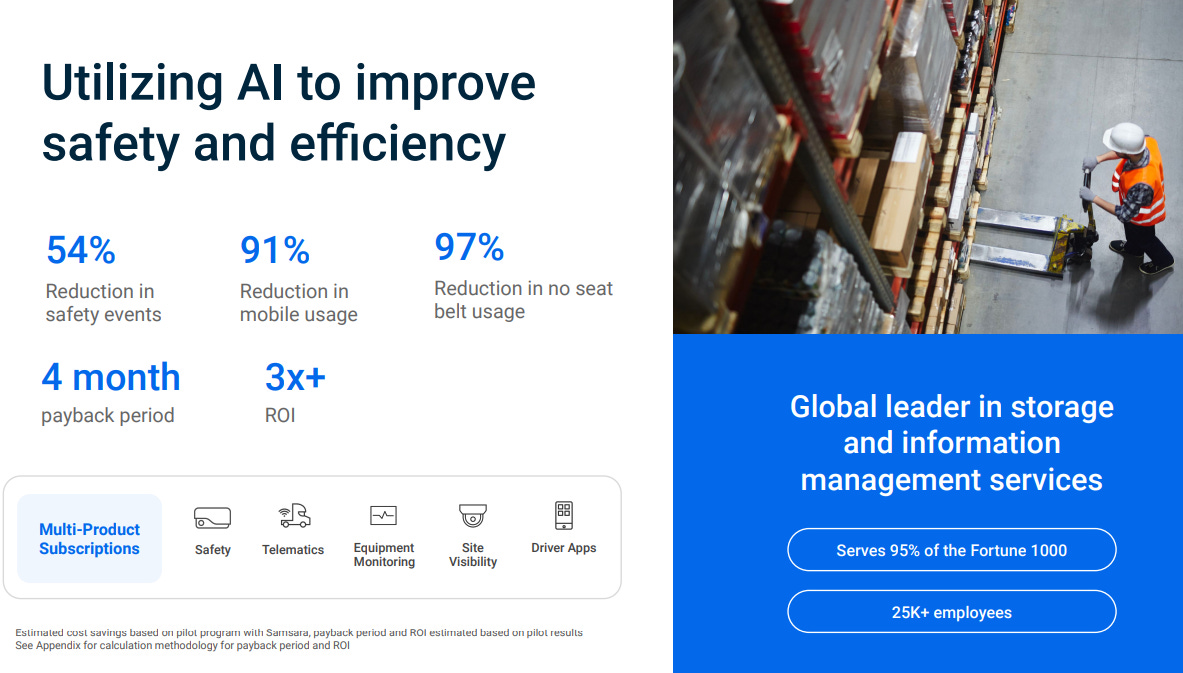

Its key benefits include targeting a distinct operations budget, delivering significant ROI, and offering customers a quick payback period.

ROI & Payback period are driven by:

Reduction of fuel costs

Extensions of asset lifetime

Measurable reductions in accidents

Reduction of expensive insurance claims

Overall improvements in social and environmental goals

Providing a competitive advantage in a tight labor market

→ I’ve written about Samsara and its potential in-depth here.

Top Line Growth: Revenue, ARR & Guidance

Samsara delivered strong growth amidst challenging macro conditions. Revenue was $204M, growing 43% YoY and beating guidance by 6%.

ARR shows a similar picture: It came in at $856M, growing 41% YoY. $61M of that is net new ARR, growing 24% YoY and accelerating by 4 pps compared to a year ago.

Samsara’s strong growth was driven by several factors.

First of all, the core business performing well:

Impressive large customer momentum

Strong expansion rates of existing customer

Excellent productivity by Samsara’s (Sales) team

Strong demand (!) meeting Samsara’s ROI and quick payback periods

Additionally, Samsara is expanding its core business beyond vehicles and transportation into “New Frontiers”.

This strong Q1 performance resulted in a 3% raise of full-year guidance, from $248M to $274M at the high end.

While Samsara saw strong demand in Q1, it also noticed a macro-impact on its pipeline:

Elongated sales cycles since mid-last year.

Customers shifting purchase decisions higher up in the ranks.

Some impact on pipeline coverage and conversion (a subtle remark).

Strong Top-Line Growth Driven by Large Customer Momentum & Expansion

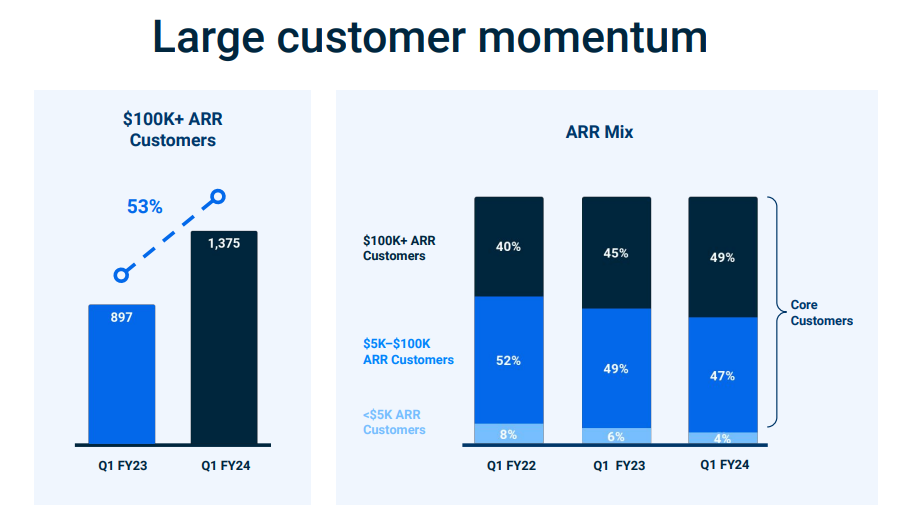

Large customer momentum was THE highlight of this earnings report. Samsara added 138 new large customers, up 53% YoY and outpacing revenue growth.

ARR from large customers outperforms total ARR growth at 52% YoY, up from 51% in the previous quarter. The share of total ARR attributed to large customers has also been increasing:

Q1 '24: Large customers accounted for 49% of ARR

Q1 '23: Large customers accounted for 45% of ARR

Q1 '22: Large customers accounted for 40% of ARR

Large customers, including well-known Fortune 1000 companies such as United Rentals, Iron Mountain, and Werner Enterprises, have become the fastest-growing customer cohort.

Great news: large customer momentum not only shows in new additions but also in the strong expansion of existing customers.

In Q1, more than 70% of large customer additions were from existing customer relationships. This contributed to record expansion, accounting for 60% of Annual Contract Value (ACV) this quarter.

Not because of weak, but despite strong customer additions.

Net retention rates this quarter were above expectations and expected to be for the rest of the year:

115+% for core customers ($5k+ ARR)

120+% for large customers ($100K+ ARR)

Samsara mentioned a healthy mix of expansion upsells and cross-sells. They don't prioritize new logos over expansions (or vice versa).

Instead, they focus on growing ARR as quickly as possible.

New Frontiers

Another contributor to Q1's strength beyond core business was Samsara's growth in “New Frontiers”:

Non-vehicle product growth: 15% of Q1 net new ACV came from non-vehicle applications, primarily driven by strength in equipment monitoring. This segment ended the quarter at approximately $100M of ARR.

International expansion: A record 17% of Q1 net new ACV came from non-U.S. customers, with strong traction in Canada, Mexico, and Western Europe. Interesting: Western Europe is a larger market opportunity than the U.S., looking at the number of operations assets.

Strength in the non-transportation segment: 83% of Q1 net new ACV came from non-transportation customers. As the company expands, the contribution of transportation to the ARR mix is expected to decrease. This shift is not a result of transportation weakness, but rather due to new use cases made possible by Samsara's versatile platform.

Promising:

Samsara just started officially reporting “New Frontier” metrics this quarter. I take that as a sign that they are serious about moving beyond their bread-and-butter business into smart factories and other exciting areas.

Bottom Line: Improving Leverage

While revenue and large customer momentum were my highlight, cash flow, and margins also show improving leverage.

Samsara's gross margins remained steady at around 73% (non-GAAP) and 72% (GAAP). Compared to last year, the non-GAAP operating margin improved from -18% to -9%.

Samsara expects its op margin to remain flat for Q2, but improved the full-year outlook to -5%, up from -7%. This improvement is primarily driven by better leverage from G&A expenses, along with minor enhancements in S&M and R&D spending.

Adjusted free cash flow (FCF) margin showed strong progress, improving from -36%- to -1% year over year. Mainly due to better operating leverage and ongoing enhancements in working capital management.

In the past, operating and FCF margin developments were not as closely aligned. Going forward, Samsara expects them to deviate by max. 5%.

Strategy & Artificial Intelligence (AI)

”A key differentiator for Samsara is how we use AI to transform customer data into business impact.”

Samsara has a unique data set spanning operations data across industries, geographies, and customer sizes.

Why are data moats exciting?

George Kurtz, CEO of CrowdStrike, explained it best:

"While we expect that LLMs will become commoditized over time, the data on which they are trained will not."

Because of that broad spectrum of customers, Samsara aligns its R&D with 80 - 90% of common use cases rather than focusing on specific verticals or new products.

For verticals, they fall back on their large integration and partner network.

Samsara’s AI Use Cases Going Forward:

Using insights from video, text, and sensor data to make operations more efficient;

Copilots to improve the quality and efficiency of workflows;

Expert assistants in areas like safety and compliance.

I like that Samsara closely aligns its R&D priorities with customer feedback. This quarter, Sanjit Biswas, CEO of Samsara, even went “on the road to meet some of the key customers in the US and Europe.”

While it’s not easy to increase your footprint in the IOT industry, I believe Samsara’s strong execution and customer centricity provide a competitive edge.

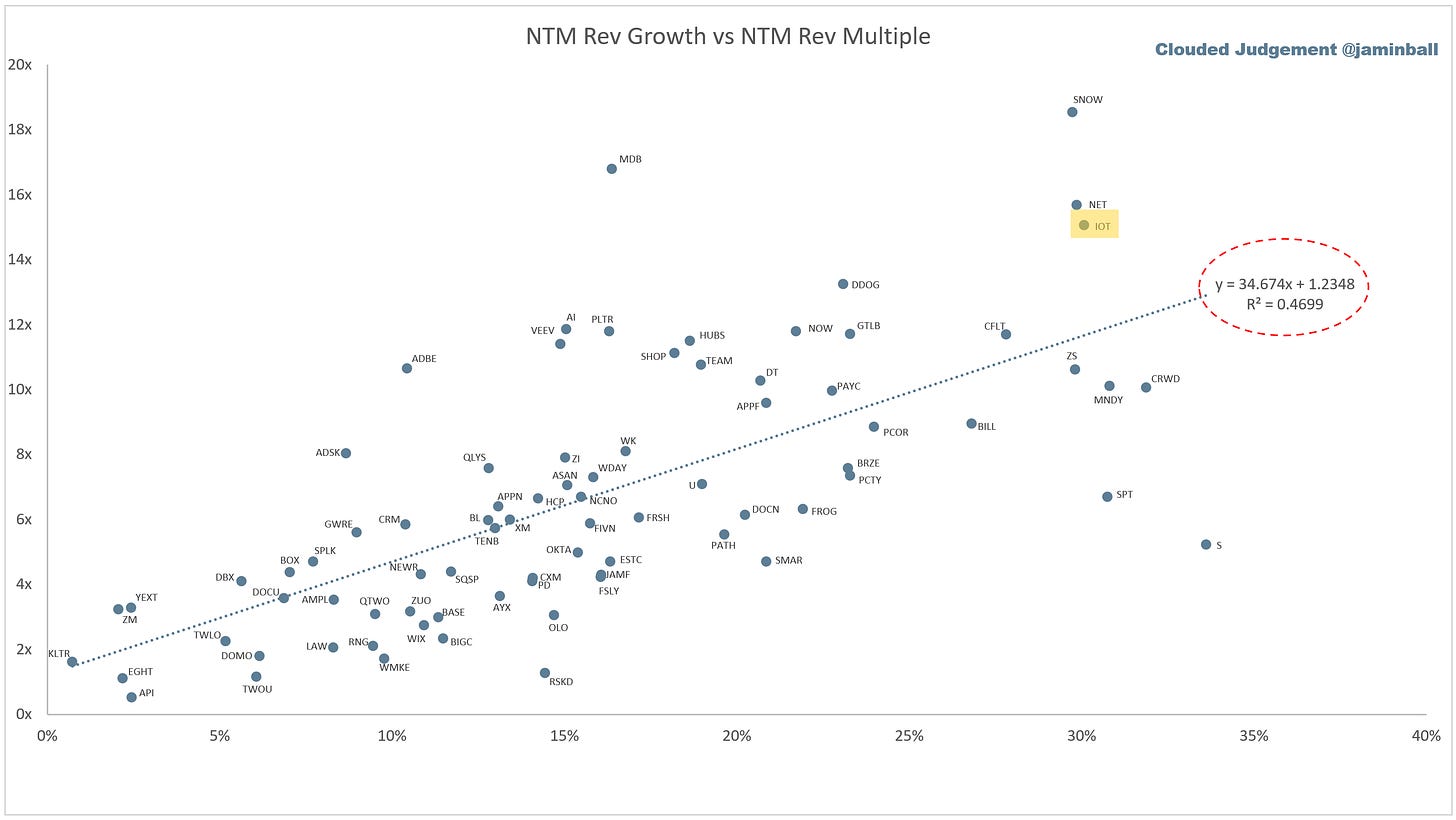

My Investing Decision

Samsara shows strong growth, execution, and a large runway, propelling its YTD and multiple. Compared to MNDY 0.00%↑ or CRWD 0.00%↑ which grow at a similar rate but are more profitable, Samsara can be considered pricey.

While valuation is not my main investing criterion, I like to consider it when deciding whether to add new cash in smaller or bigger tranches.

If you’re interested in the risks of investing in Samsara, pls see my previous article.

⟶ I currently have a 3% position in Samsara and plan to increase it opportunistically to 5%.

Thanks for reading, and Happy Investing! 🎉

Disclaimer: This text is for entertainment purposes only and does not represent any investment advice, stock buying or selling recommendation, or any other financial advice. So please always do your own due diligence and make your own decisions. See our disclaimer for more details.