Sentinel One's (S 0.00%↑) stock price plummeted by 35% following their earnings report.

Here's why:

Key Highlights

Revenue missed Sentinel One's own Q1 guidance by 2.6%, coming in at $133.4M, up 70.5% year over year, and 5.8% quarter over quarter.

During the earnings call, management explained the miss due to customers generating less consumption-based revenue. Unfortunately, that's just one of multiple issues.

Revenue guidance for FY ‘24 was reduced to $600M from the previously guided $679M. This was shocking, as a slight raise was expected instead. Last quarter, I expected them to achieve 60% at the end of the year, but now I'm thinking they might achieve 50% at best.

Revenue guidance for Q2 of $141M was lower than expected, but still implies a slight sequential acceleration from 5.8% in Q1 to 6.8% in Q1 considering a 1% beat. Note: Q2 revenue will likely slow down to 39% year over year due to tough comps versus previous years’ Q2, when they acquired Attivo.

But how can I expect a beat next quarter, while they've just missed the revenue guide for Q1?

Let me explain:

Net new ARR was lower than expected at $41.6M, up 40.1% year over year, but down 29.5% quarter over quarter. The sequential decline in net new ARR is likely due to seasonality. However, the real issue lies in their historical methodology for tracking ARR.

ARR guidance for FY ‘24 has been reduced to $522M, representing a 35% YoY growth, down from the previously guided 41%. This reduction in revenue is a real bummer.

In the last quarter, I noted:

"CFO Dave Bernhardt couldn't help highlighting multiple times how conservative that forecast is. I try not to read too much into it, though he seemed really eager to convey how low that guidance is. I'd like that, but his last mistake guiding to 50% ARR growth 90 days ago makes me wary."

Unfortunately, the guidance is even lower now.

Four Reasons:

In recent years, management has observed a steady increase in usage and consumption patterns by their large customers, which accounted for real-time and quarterly ARR. However, during the first quarter, they experienced a noticeable decline in usage, which continued in May:

As a result, management saw a shortfall in revenue during Q1 and conducted a deep dive into their customer base. During the investigation, they discovered that excess consumption-based revenue was included in the ARR calculation. "Excess" refers to the additional amount that customers have to pay if they consume more than what was contractually agreed upon.

This consumption-based revenue makes up to 5% of total revenue and is generated from data ingestion, the security data lake, and the data set consumption products.

The issue: They should have never included the excess consumption-based revenue into ARR, since ARR means "annual recurring revenue," which consumption is not. Due to the volatility in consumption (similar to Snowflake’s or Datadog’s), the revenue guides were honest but fell short.

To reduce ARR volatility from changes in usage-based consumption and better align ARR with revenue, management decided to change the methodology for calculating ARR for consumption and usage-based agreements to reflect committed contract values.

The bright side: Once customers consume more than what was agreed upon in the contract, there may be an additional upside in revenue beats surprising investors.While conducting the deep dive, management also discovered and corrected some historical recording inaccuracies relating to ARR classifications of certain contracts that they identified during the ARR review. An error in their CRM added renewals on top of upsells, which should now be fixed and not happen again.

Macroeconomic conditions have impacted deal sizes and sales cycles. Budgetary scrutiny has resulted in deal size adjustments for new customers and renewal contracts, as is happening in other businesses facing similar challenges.

Management was disappointed by some execution challenges in the late stages of contract negotiations for large deals, which caused a few deals to slip to the next quarter. They highlighted a multimillion-dollar deal with a customer who had already fully deployed Sentinel One's solution but could not close the deal in Q1 due to contract delays.

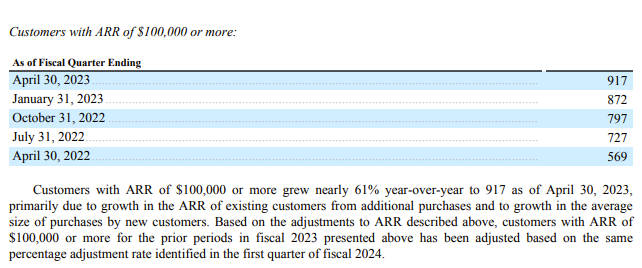

Overall, the change in methodology and correction resulted in an ARR reduction of $27 million or approximately 5% of total ARR as of Q4 FY23, as well as a comparable estimated adjustment to the remaining quarters in the fiscal year 2023.

Unfortunately, the reduced revenue guide has pushed the target to break even from Q4 FY2024 to FY2025. However, progress toward profitability remains on track:

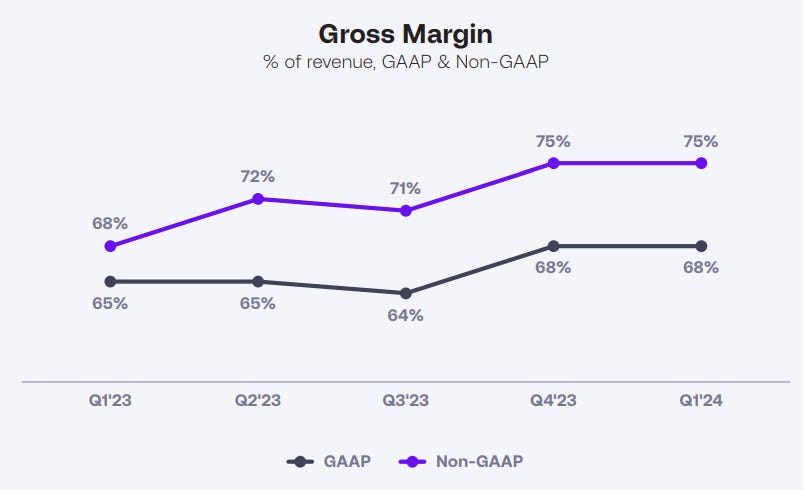

The Q2 operating margin guide has improved to -36%, up from -57% in Q1 2023, and remains on track. The FY ‘24 gross margin guide has been slightly raised from 74.5% to 75%, and the FY ‘24 operating margin guide of -25% remains unchanged.

To achieve these targets, Management announced a plan to optimize their workforce that is expected to impact around 5% of current employees and affect future headcount growth plans.

Margins and cash flows have improved across the board:

Gross margin has increased to 75% from 68% last year.

Operating loss was -$50.76M (-38.1% of revenue), which matched my expectation and is a strong improvement from -$57.44M (-66.1% of revenue) a year ago. The smaller loss resulted from revenue growth exceeding the increase in expenses. It's also worth noting that Q1 is usually their weakest quarter for profitability due to front-loaded expenses.

Net loss was -$42.25M (-31.7% of revenue), up from -$56.98M (-72.8% of revenues).

Operating cash flow was -$28.06M (-21% of revenue), up from -$49.35M (-63.1% of revenues).

Free cash flow was -$31.43M (-23.6% of revenue), up from $54.73M (-69.9% of revenues).

Sentinel One continues to invest aggressively in Sales & Marketing, accounting for 63% of its revenues, to capture market share. This indicates that they are not scaling back their go-to-market efforts as they pursue profitability.

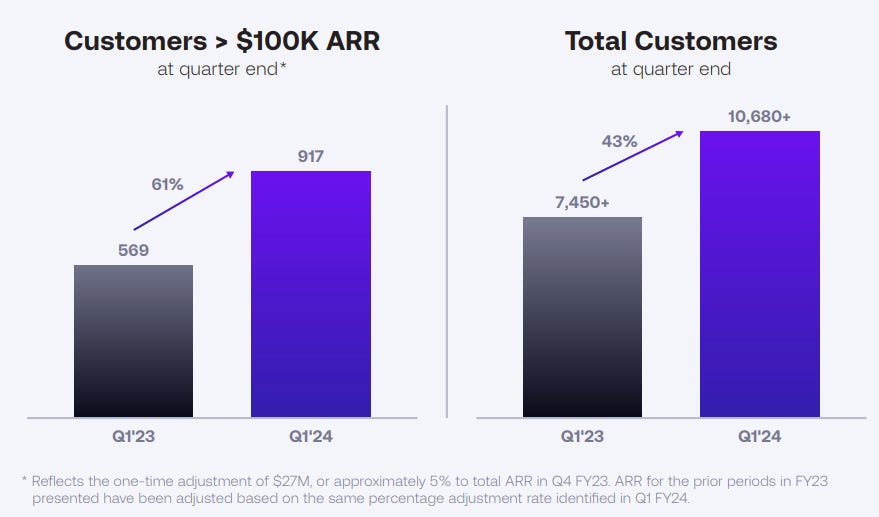

Looking at customers, Sentinel One added 680 customers, bringing their total to 10,680, which is a 43.4% increase year over year and 6.8% increase from last quarter. However, this quarter's growth rate slightly decelerated compared to the previous quarter.

More important is the progress in customers spending more than $100k:

In Q1, Sentinel One added 45 net new customers of the $100k cohort, bringing the total to 917. This represents a 61.2% increase year over year and a 5.2% increase sequentially.

Unfortunately, I can’t compare Sentinel One to Crowdstrike, as Crowdstrike no longer reports customers and never reported a $100k cohort.

Comparing the performance to other software businesses with a $100k+ customer cohort:

ZScaler added 95 net new adds (4.3% QoQ) vs 140 net new adds (8% QoQ) a year ago. That makes the development look solid for Sentinel One since Zscaler shows a similar weakness and the lowest amount of $100k customers in almost 3 years.

Datadog added 130 net new adds (4.7% QoQ), vs 240 net new adds (11.9% QoQ) a year ago. The lowest amount of customers spending more than $100k in the past 3 years.

Furthermore, it’s worth noting, Sentinel One added 1 net new Fortune 10 customer, now protecting half of them:

Walmart, Amazon, Apple, CVS Health, UnitedHealth Group, Exxon Mobil, Berkshire Hathaway, Alphabet, McKesson, Chevron.

My takeaway: When considering other companies’ performance in the current environment, customers for Sentinel One aren’t falling off the cliff, but going forward I’d like to see a stabilization or acceleration in growth, soon.

The Dollar-based Net Retention Rate was a solid 128%, but down from 130%+ last quarter. Customers continue to consume less and we can see a decline in that metric for all companies in that environment - like Snowflake SNOW 0.00%↑or Datadog ( DDOG 0.00%↑).

I’m seeing no issues here since a) Management highlighted to be confident in staying above 120%+ and b) the gross retention rate “has essentially been flat for the past eight quarters or so. I don't think it's deviated more than 1 point. So one of the things that Tomer had talked about is when customers use us, they don't tend to leave us”.

Lastly, ARR per customer increased by more than 20 percentage points year-over-year demonstrating success with large enterprises as well as increasing adoption of broader platform offerings.

Notable Developments

Sentinel One has launched Purple AI, which enables users to control all aspects of enterprise security, from visibility to response, with speed and efficiency. Customers and prospects had hands-on access to a live demo of Purple AI at RSA, the world's largest cybersecurity event, and the feedback was very positive.

Dilution increased by 6.9% year over year, which is much too high. Ideally, I would like to see a maximum annual increase of 2-3%. However, in Q4, they announced that they expect dilution to slow to 5% YoY in FY2024, which is a significant improvement from the previous year.

My Investment Decision

I trimmed slightly on the way up to $17, but I don't plan to sell further for now.

Here's why:

Obviously, the CFO made significant rookie mistakes and should be held accountable. Executives left Sentinel One a few quarters’ ago to join Crowdstrike (CRWD 0.00%↑) and lowering revenue guidance is also never a good sign. Furthermore, management highlighted deals slipping due to execution challenges. Dilution needs to slow down. That’s a lot of flags!

On the other hand, management has been sincere and upfront about their mistakes. Most importantly, the adjustment to Annual Recurring Revenue (ARR) did not impact historical revenue, total bookings, cash flows, or income statement. Moreover, the ARR for the quarter was in line with management's expectations, except for the consumption downsizing.

By taking out the excess consumption revenue from ARR, they were forced to take the guide down, which is the right move to reduce volatility. Management highlighted that key factors like competition environment, win rates, and the healthy pipeline didn't change.

Customer growth isn’t falling off the cliff. In fact, they have even added one of the top 10 largest companies in the US by revenue, and now protect half of them.

Furthermore, the progress to profitability remains on track, although it has been slightly delayed until FY2025. With $1.1 billion in cash and no debt, Sentinel One has plenty of financial runway.

I'm taking a calculated bet when considering all the puzzle pieces, including listening to what management said, the low valuation, and the market cap.

I believe the risk/reward looks decent: With a market capitalization of only $4B, and a forward EV/S of just 6, the company is still growing at a healthy pace and has visible progress toward profitability.

I'm controlling the risk part of that equation with the size of my allocation, which sits at 6%.

If I'm right about my bull thesis, there is significant upside potential.

If I'm wrong, I expect to lose another 50%, which means a 3% loss for the total portfolio, plus lots of learning. I can live with that.

Some people say that Sentinel One is losing to Crowdstrike, but I wonder if that's the right question to ask. The cybersecurity market is large enough for everyone, with a total addressable market (TAM) of $100 billion.

Even Microsoft, a leading security provider, has only captured 1/5 of the market, leaving the remaining 80% for other providers. In my opinion, it's not a matter of Sentinel One versus Crowdstrike. Rather, it's about how well Sentinel One performs on its own in the future.

Please note: This is not a bullish take on a romantic cybersec-story that might or might not unfold in the next few years. I have no idea about the future, as I don’t have a crystal ball.

I don't think I will hold Sentinel One forever since I lack the long-term conviction I have in businesses like Snowflake (SNOW 0.00%↑). I may even trim opportunistically ahead of earnings.

These results would make me to finally sell out:

Another downgrade of the FY revenue guide

Not meeting their net new ARR guide

A sequential slowdown of $100k customer growth, while peers don’t show the same

No progress on their path to profitability

However, I believe there could be more near-term upside than expected. As usual, please don’t follow me blindly and make your own judgment.

Thank you for reading, and Happy Investing!

Disclaimer: This text is for entertainment purposes only and does not represent any investment advice, stock buying or selling recommendation, or any other financial advice. So please always do your own due diligence and make your own decisions. See our disclaimer for more details.