Every month I’ll provide updates on my stock portfolio to share my investment philosophy, holdings, and foster mutual learning.

For more frequent updates and my expectations for the next earnings season, follow me on Twitter: @MoritzMDrews

Let's dive in!

Here's a thought I've carried with me since I started investing over five years ago:

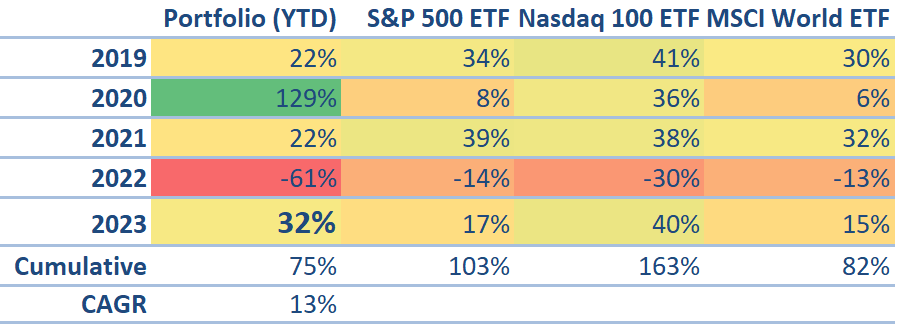

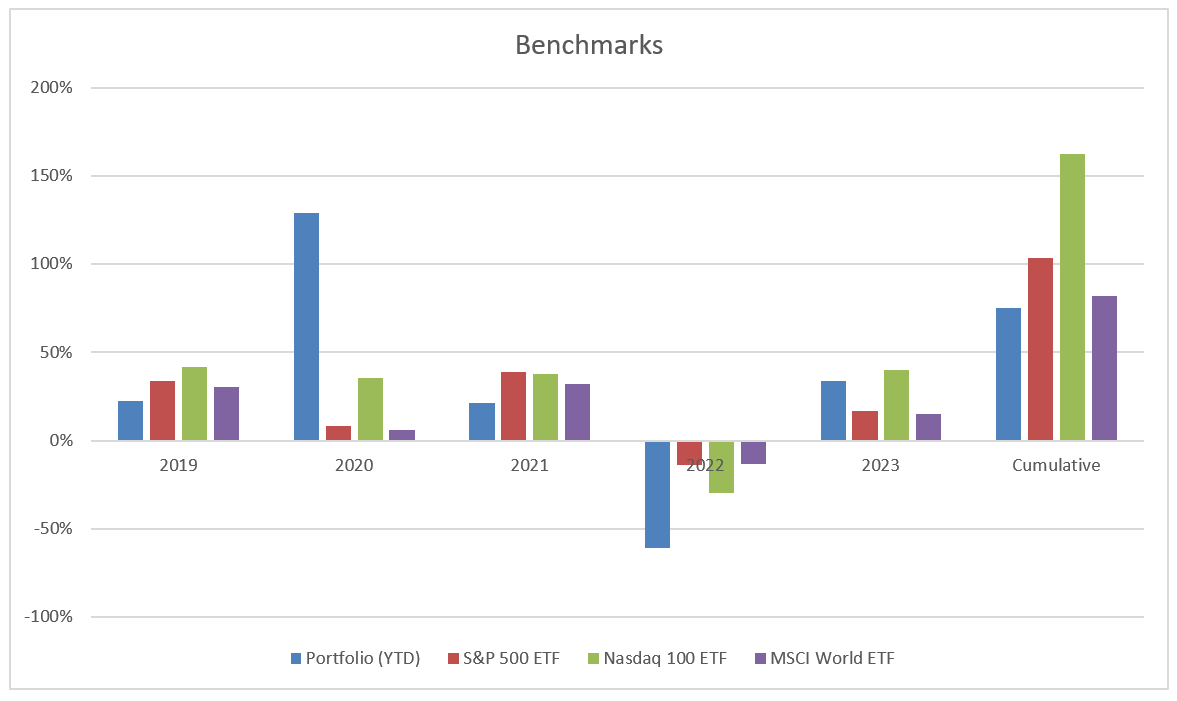

My biggest fear in investing is not huge drawdowns - I survived a -61% drawdown on my portfolio in 2022. It's not the fear of recessions or economic downturns - they happen every seven years on average. And it's not black swan events - I focus on what I can control.

My biggest fear is being unable to adapt to the constantly changing world of investing. The ability to course-correct is necessary because what worked in the past might not work anymore tomorrow.

I highly regard Saul for his ability to adapt to change, which helped him achieve an astonishing 30+% CAGR over the past decades. Now, I feel that the time has come for me to become like a tiny water drop that has to find its own path, a path that feels right to me.

This review marks an inflection point in my investing journey, leading me to be more active than usual since I’ll gradually shift to a different approach as I’ll explain in a second. I expect this to continue for the next few quarters until my portfolio aligns with the course correction I'm currently undertaking:

After much reading and contemplation, I’ve come to question what type of investor I truly want to be. I’ve decided that I want to be someone who optimally holds companies for decades and sees themselves as an owner of a growing business.

This led me to the question of how I can maintain my conviction if things go down in a quarter or two. And I’ve found my answer: it is all about people.

This means that my primary focus is investing in the people, the leadership, and the culture behind great companies. I search for individuals with a profound understanding of how to build strong cultures, reinvest efficiently into their company, and create successful businesses that are driven by long-term secular trends.

Additionally, they have a significant personal investment in their own company. I deeply believe that, in the long term, people are the most important factor in determining a company's success.

So instead of obsessing over P/E ratios, changes in sequential growth metrics, or how frequently the CEO mentions "AI" in earnings calls, it’s ultimately the leadership and the people they hire who are crucial.

It is the talent that ultimately drives durable growth for decades.

I’ll always prioritize growth, but it doesn't have to be hyper-growth. When I say growth, I'm referring not only to revenue growth, but also earnings growth, cash flow growth, and margin expansions.

I'm satisfied with any type of healthy growth that has the potential to last for at least a decade. I'm looking for a combination of significant growth metrics, and I’ll be okay with lumpy revenue growth. This doesn't mean I won't consider or invest in "unprofitable" hyper-growth companies anymore. I'll still invest in the best of them.

Nevertheless, what has changed is that I stopped putting labels on things. I try to look beyond categories like Small-, Mid-, and Large Caps, growth vs. value, or trendy SaaS businesses with recurring revenue models versus boring, unsexy offline companies.

Moving forward, I'll consider them all and choose the ones that I believe will help me achieve my goal of an ambitious 20% CAGR over the next few decades. I want to be an actual business owner, investing in companies, that I can easily understand and monitor. All that raises the bar pretty high. And once I’ve found a company that checks all the boxes I plan to hold on to it.

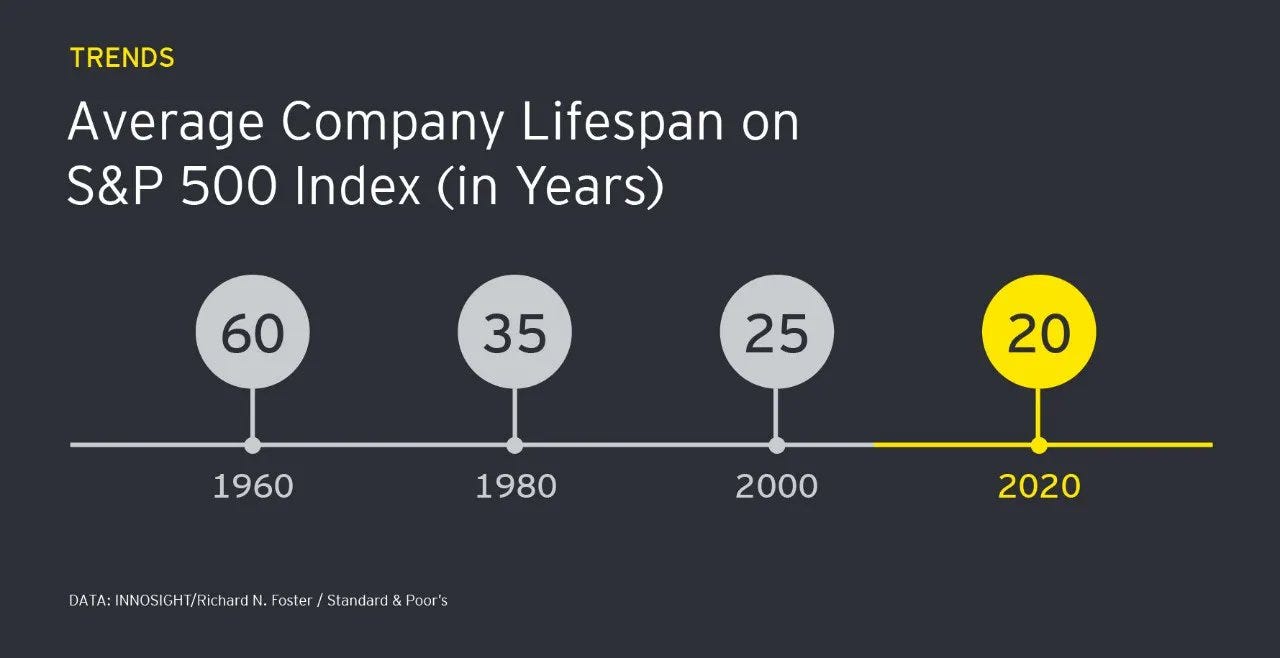

However, I won't blindly invest with a "buy and hold" mentality forever. Due to constant change, innovation, and technological disruption, the average lifespan of companies is decreasing. This approach is a thing of the past and only works with ETFs anymore.

This means that I’ll still sell if the time has come. But instead of basing my decisions on a sequential change in some metrics, I’ll rely on a clear investment thesis that I have written down for every company I own. This time may come tomorrow or 10+ years from now. Nevertheless, as long as the investment hypothesis remains intact and I have faith in the people driving the venture, I will stay on board.

Here's a quote that resonated with me last month:

“Be like water making its way through cracks. Do not be assertive, but adjust to the object, and you shall find a way around or through it. If nothing within you stays rigid, outward things will disclose themselves.

Empty your mind, be formless. Shapeless, like water. If you put water into a cup, it becomes the cup. You put water into a bottle and it becomes the bottle. You put it in a teapot, it becomes the teapot. Now, water can flow or it can crash. Be water, my friend.”

― Bruce Lee

Portfolio performance

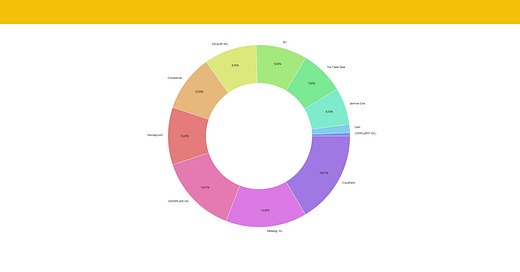

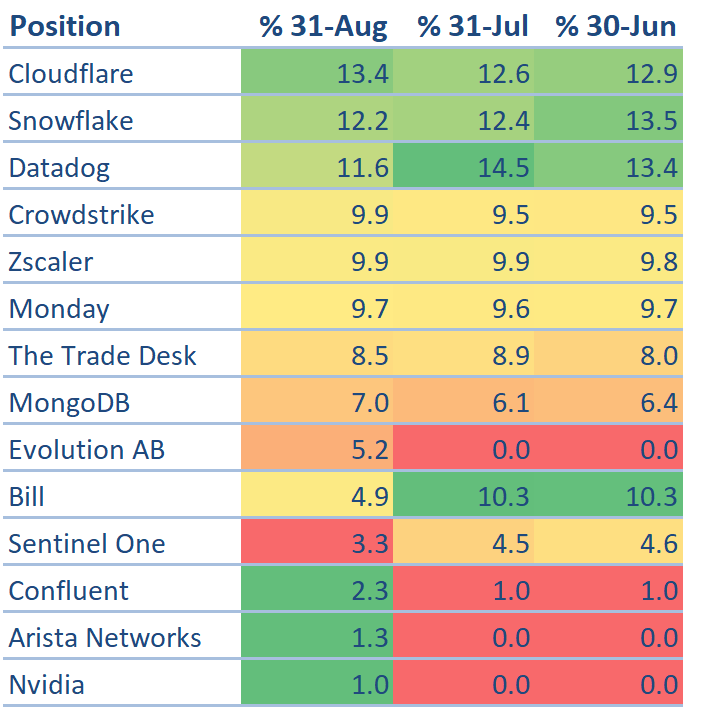

Portfolio allocations

Recent changes to the portfolio

Positions I trimmed

Datadog – DDOG 0.00%↑

Initially, I was confused by the low customer growth, with only 600 new customers added and just 80 customers spending more than $100K ARR during the quarter. This negative trend has persisted for a few quarters now. However, after conducting more research, I gained clarity. Despite this trend, my conviction remains strong. Why:

Customers are using more modules, indicating that they still love Datadog.

Management, whom I trust, sounded highly convinced of the company with future growth picking up again.

The quarter was impacted by several events that made it look odd: a) macro still dragging consumption b) seasonality impacting larger customers in Q2 c) low churn on the meaningless low end, d) a one-time cleanup of 200 low-end, tiny customers to free tier (also meaningless).

Management highlighted record-high bookings, which indicates that more meaningful customers on the high end were acquired or extended their contracts. The reason why these customers didn't show up in the $100K cohort is because they aren't spending the "booked" value to get over that $100K ARR threshold, yet. This is due to budget scrutiny and ongoing optimizations.

Remaining Performance Obligations, the "backlog" of what customers commit to future spending, accelerated to 41.9% YoY and 9.6% QoQ. Also, cRPO growth, revenue that is recognized in the next 12 months, accelerated to 30% YoY. Essentially, Datadog’s customers signed up to spend significantly in the future. It's just a matter of when they pull the trigger.

In short:

Existing customers still love DDOG.

New customer growth is healthier than it appears.

Macro, scrutiny, and optimizations won't last forever.

I still trimmed my position slightly to align it with my other larger holdings. You can see this move as part of my "inflection point," which I noted at the beginning of this summary.

Despite the significant drawdown of the stock over the past two years, my position is still up over 180% since I bought it. Selling would mean paying taxes, and I plan to invest for the long term. The thesis for Datadog remains intact, and going forward, I will try not to touch it anymore if possible. (Please remind me if I forget, since I am fallible).

Crowdstrike – CRWD 0.00%↑

A few weeks before Crowdstrike's earnings, I trimmed my position slightly to allocate funds to my new investments. Although earnings were solid, I was expecting more revenue growth for the quarter.

Nonetheless, it’s great to see a net new ARR of $196M, which is higher than expected. There was also a nice acceleration in RPO growth, indicating customers plan to spend more in the future.

In addition, customers are purchasing more modules, and Kurtz announced that Crowdstrike is now GAAP profitable with $8M in quarterly revenue. As a result, I remain a calm shareholder.

Zscaler – ZS 0.00%↑

Similar to CRWD, I trimmed ZS slightly because I needed funds. I wanted to bring the position to a level where I feel comfortable, but I will be much less active in the future due to my course-adjusted investing style. Zscaler reports on 9/5, and I expect them to deliver solid results.

SentinelOne – S 0.00%↑

Sentinel One reported solid numbers and the stock is up about 40% since its recent drawdown:

Beat revenue guide by 6%, reaching $149.4M, a 46% YoY increase, and a 12% QoQ acceleration.

Gave a solid Q3 guide of $156M (I had expected $151M).

Raised the FY guide to $605M, up from $600M.

Added 77 customers spending >$100k, 8.4% sequentially, accelerating.

All margins continue to improve and are working out as planned.

Organic DBNRR is over 120% instead of the reported 115%, which is influenced by last year's Attivo acquisition.

Management also mentioned they are collaborating with four large accounting firms to ensure that the whole ARR issue influenced by consumption revenue, which happened in the last quarter, will not happen again.

Additionally, they stated that rumors about a potential acquisition or the cancellation of the partnership with Wiz are unfounded.

While all of this sounds great and worked out as I had laid out in my last quarter’s writeup (which I recommend reading to understand the whole situation), I trimmed my position ahead of earnings at the $17 region.

My plan was to opportunistically trim if the stock kept going up because I didn't know for sure what would happen, so that’s what I did for risk management. They made some significant mistakes which I shouldn't ignore. I used most of the funds to allocate to existing and new positions I have conviction for the long-term.

While I liked the quarter, I’ll continue to think this through and let you know about my decision next month.

One observation I made was how negative everyone suddenly became. There was immense pressure coming from all sides, especially on FinTwit (FinX?).

But it's important to tune out the noise and focus on what really matters: the people behind the company one is invested in. I don't want to invest in just some random metrics; I'm investing in real people driving a venture. And when they speak up, I listen.

bill com – BILL 0.00%↑

When it comes to writing about companies, some energize me while others feel like work. Unfortunately, Bill falls into the latter category and continues to be my most complicated company to follow. Here are my thoughts on the quarter:

Subscription revenue remained flat at 0.3% QoQ. However, it's worth noting that my previous writeup stated that "the subscription price increase is now in their run rate numbers, and as a result, we can expect a smaller sequential subscription revenue increase compared to recent history." Also, subscription revenue only makes up 25% of total revenue.

TPV growth from BILL standalone customers remained flat, but management expected this last quarter due to lower TPV performance in Q3. Dollar-based-net-retention rate was 111%, down from last year's 131%. While this isn't the right direction, I can't think of a single (non-consumption-based) company that has a better DBNRR these days due to macro trends.

Customers coming from financial institutions declined by -10% QoQ, but this was expected due to Bank of America sunsetting the BILL-powered legacy ACH and Check bill pay solution used by their commercial customer segment. It's also worth noting that BILL core customer growth accelerated to 4% QoQ (versus last quarter's 2.8%) after excluding customers coming from financial institutions.

There was some nice revenue growth from Divvy (12.8% QoQ), and Divvy Total Card payment volume was up 11.8% QoQ. Operating income reached a record high of $42.3M, and net income was $69.4M. Operating cash flow increased significantly to $80.4M (up from -$10M a year ago), and free cash flow was $73M (up from -$15M a year ago).

However, customer growth coming from Divvy was a bit light at 7.7% QoQ, which could be due to seasonality.

In summary, the quarter was "okay" with no red flags. I was happy to see strong profitability. However, going forward, I hope to see stronger customer growth, especially for Divvy, and an FY revenue guide raise. Due to the combination of okayish results, although still strong considering the overall environment, I don't feel confident with BILL in the long run. I'm not convinced that their "acquisition engine" will work out well, and it's possible they could hit a wall in the next 12 months.

I kept trimming throughout the month and allocated the cash to other positions. For now, I plan to keep 5% in BILL, but I'll likely sell out next quarter to make room for a better alternative.

Positions I increased

The Trade Desk – TTD 0.00%↑

I thought the quarter was rock solid as usual and even better - revenue growth accelerated to 23% year-over-year and sequentially. Based on the guidance I expect that trend to continue. All relevant metrics keep improving, and they even improved GAAP net income to $33M, up from $9M a quarter ago. When the stock tanked after earnings, I couldn’t hold back and added a bit.

Just this week TTD announced that its CTO David Pickles steps down. He worked at the company for over a decade. Only time will tell what that means for the company. Still, my conviction remains high. Remember, when Crowdstrike’s CTO stepped down 2 years ago? Didn’t hurt them obviously.

The Trade Desk is one of the easiest companies to follow and one of my best performers since I first bought it almost 5 years ago.

If you are not familiar with The Trade Desk, here is a quick primer on what makes it so intriguing based on some of my older notes:

Facebook, Twitter, Google, and other social media platforms work very well for performance marketing, but they cannot convey emotions effectively. The big brands and conglomerates, such as McDonald's, Nike, Lindt, Dr. Ötker, BMW, etc., rely on emotions in their advertising, and they urgently need a platform where they can let their creativity run wild, without being limited by performance figures like CPCs (cost-per-click) and CPAs (cost-per-acquisition).

Linear TV is dying, and more and more people are consuming media online, mainly via mobile devices and platforms like YouTube, Disney, or Netflix.

However, the small screens of mobile devices, often used without sound, do not allow for emotional impact. Moreover, users have full control over their online experience, so video ads before or after a YouTube video do not have the same emotional impact as a commercial tailored to the target audience, consumed via a connected TV on a large screen with sound.

By using The Trade Desk and its data-driven targeting, companies can reach their audiences more effectively and reduce waste significantly, making ad dollars spent on connected TV more valuable than those spent on linear TV.

This creates opportunities for companies to create emotionally charged advertising that resonates with their target audience, leading to higher engagement and increased brand loyalty. Roughly every dollar spent on linear TV is worth at least twice as much on Connected TV and its TAM is huuuuuge. As you can imagine, I like TTD!

Confluent – CFLT 0.00%↑

Confluent remains a small starter position for me, sitting at 2%. Overall, the quarter was decent with the following highlights:

Beat their Q2 cloud revenue guide by 2%, achieving $189.3M, a sequential acceleration to 8.8% (seasonality driven though).

Cloud revenue is decelerating, which I assume is muted by macro factors. However, as a percentage of revenue, it is increasing to 44%, and the raw dollars added ($10M) for the quarter is higher than last year.

Raised fully rear revenue guide by 1% to $772M from $765M.

Hired a new CFO, Rohan Sivaram, who was senior vice president of finance at Palo Alto Networks.

The company sits on $1.85b cash and is moving towards non-GAAP profitability with improving margins, so there is no cause for concern (non-GAAP net income was positive for the first time).

Solid RPO, which keeps stabilizing.

All customer cohorts grew very healthily, especially the $100k and $1M cohorts, which make up 85% of total ARR.

If you want to learn more about the company, I recommend reading my last writeup and Peter Offringa’s take on the quarter.

I added and may continue to add opportunistically, but I am not in a hurry to do so. This company has the potential for a very long runway for years to come.

MongoDB – MDB 0.00%↑

Impressive: MongoDB generated a revenue of $424 million, which represents an acceleration of 40% YoY and 15% sequentially. Although the Q3 guide was rather weak (below my expectations), I assume there was some one-time impact which I have yet to confirm during the earnings call. However, the weak guide was offset by the strong full-year raise to $1.608 million, up from $1.542 million (a 4% raise!).

While Atlas's revenue is still strong, it declined slightly as a percentage of revenue (to 63% from 65%) due to the exceptionally strong performance of the non-Atlas business. Atlas revenue is primarily based on customer consumption of the platform, which is closely related to end-user activity of the application and can be affected by macroeconomic factors. I can only imagine what happens once consumption picks up again!

Overall, customer growth was solid, and margins improved across the board.

Since MongoDB is one of the most expensive in my portfolio, I might not add further from here since I'm already happy with the position size. However, I still have to read through the earnings transcript, and that might make me change my mind.

Snowflake – SNOW 0.00%↑

Snowflake had a strong quarter, with product revenue reaching $640M, a 37% YoY increase. Sequential growth accelerated to 8.1%, and remaining performance obligations saw a healthy sequential increase of 3.8%, up from -6.9% last quarter. Although the dollar-based net retention rate (a lagging metric) decreased to 142%, it is still best-in-class and expected to improve with consumption in 2024.

Customer growth slightly improved, with 4.5% sequential growth, and 22 Global 2000 customers added during the quarter. However, the number of customers spending more than $1M in the last 12 months did not perform as well, but this is likely to be due to customer optimizations during the last year that caused them to move out of this cohort(similar to dynamics observed about Datadog). This metric is expected to improve again in 2024.

Profitability improved across the board, and Data Marketplace Listings accelerated to 255 added listings, up from 56 last quarter. The number of customers using stable edge (2.220) was solid, up by 55% YoY. This metric is important to monitor Snowflake's core investment thesis, as laid out in my previous writeup here.

In mid-August, during its duration of sadness, I added a small amount to my position. And by "duration of sadness," I mean the stock price was down. But hey, that's just a nice way of saying "buying the dip."

Cloudflare – NET 0.00%↑

As a reminder, here are my thoughts on Cloudflare's lumpy earnings two quarters ago. However, last quarter's earnings looked like they were back on track. I’m not sure if they were ever off-track. Or perhaps they still are, but I’m confident in its ability to fix things.

The company delivered 6.3% sequential revenue growth at $308.5M (although this was influenced by seasonality) and raised full-year guidance slightly to $1.287M. Customer growth was fine, especially in the larger cohort. They added 196 large customers spending more than $100k, which is a significant acceleration compared to previous quarters:

121

212

159

134

114 (5.6% QoQ)

196 (9.1% QoQ)

Although influenced by seasonality, this performance is encouraging. In addition, RPO increased to $1.036M, which is a nice sequential acceleration to 8.1%. On the bottom line, Cloudflare produced great profitability across the board with a 21% operating cash flow margin, a 7% free cash flow margin (strong for Q2), and an 11% net income margin.

In August, I added a few times when the market entered an "unhappy mode" once again.

New positions

Pure Storage – PSTG 0.00%↑

In mid-August, I took a tiny position of around 1% in Pure Storage, the leader in data storage. I had owned it back in 2019 as well, but didn't feel comfortable with it. I like the emerging subscription revenue underlying the company.

Also, the whole Flashblade/E technology is astonishing, as it decreases costs by 90%. It requires 10% of the footprint, power, heat dissipation, and manual labor compared to spinning a disc. This is incredible.

Their other products, namely Block Store and Evergreen//One, which is their subscription offering, also sound very appealing. Block Store allows users to mitigate some of the elevated storage bills that have developed with the movement of many workloads to the cloud.

However, I still feel uncomfortable holding the company. I believe that holding a storage company feels like holding a commodity in the long run. Although I believe Pure Storage will do well, especially in the short and mid-term, as they are positioned to profit from the AI tailwinds, I'm not convinced about the long-term prospects.

Additionally, since I don't want to hold more than 12 positions, I had to say goodbye to Pure Storage once again.

Nvidia – NVDA 0.00%↑

Motivated by a bit of FOMO and the company's impressive performance, I initiated a position in Nvidia in early August. As an avid gamer, I’ve been familiar with Nvidia's graphics cards since the early 2000s, and I have been following Beth Kindig's analysis of Nvidia's future, particularly its data center segment, since 2019. Nvidia is a no-brainer.

Nevertheless, I’m considering selling my small position. As stated in my introduction, my goal is to achieve a long-term CAGR of 20% for my portfolio, and I am not convinced that Nvidia will deliver that for me for the decade to come. Yes, AI is here to stay, and the numbers look great.

However, this time is - again - not different. Although the stock price may double or even triple again, I anticipate the demand to level out in the mid-term, muting the stock price appreciation for a significant amount of time. In every company I invest in, I aim to hold for decades, rather than selling after a double or so. Furthermore, I believe there are better alternatives for the long term.

In addition, I do not fully understand Nvidia's business, even as a gamer, and I do not want to spend time trying to comprehend it. I prefer something simple, like TTD, whose business I can understand and follow. I don’t want to add a "cool-sounding" name to my portfolio and hope for the best.

I’m not sure what I am going to do yet and I’ll provide an update in my next month's portfolio review.

Arista Networks – ANET 0.00%↑

Arista Networks is a fascinating company that I stumbled upon. I owned it in 2019 and, being much more novice then, unfortunately, sold it.

Arista Networks creates networking equipment that acts as the plumbing for the internet. They produce switches and routers that facilitate fast and efficient data transfer between computers and devices on high-speed networks, such as the Internet or within large organizations. In simple terms, they provide the technology that enables the internet and large computer systems (data centers) to run smoothly and connect everything together. Although this may seem like a commodity, it’s not just the hardware that drives their business.

Their advanced software is what sets them apart and makes everything work seamlessly, and one reason for their 60%+ gross margin. There is a reason why they are the leading supplier to the "Cloud Titans" - as Arista Network likes to call companies such as Amazon, Google, Microsoft or Meta.

In the short term, there may be a demand normalization by cloud titans, so growth may not be smooth from year to year.

So why now?

I believe that Arista Networks benefits greatly from AI tailwinds, such as increased use of AI workloads among cloud users, faster production upgrades of data center switching products, and expanded market share with enterprise customers. Furthermore, the company has a strong leadership team, who hold 19% of the business, and a proven track record of success.

Its CEO, Jayshree Ullal, who has been with the company since its inception over a decade ago, leads the company with an intrinsic interest in its success. Prior to joining Arista Networks, she served as Senior Vice President at Cisco, where she was responsible for a $10B business in data center, switching, and services.

With over 30 years of networking experience, she has received numerous awards, including E&Y’s “Entrepreneur of the Year” in 2015, Barron’s “World’s Best CEOs” in 2018, and recognition as one of Fortune’s “Top 20 Business Persons” in 2019.

Andy Bechtolsheim, a co-founder of the company, serves as Chief Development Officer and Chairman. Before joining Arista Networks, he co-founded Sun Microsystems and served as its Chief System Architect, where he was responsible for next-generation server, storage, and network architectures.

A few metrics:

$1.3B in cash, with no debt.

Growing revenue at over 20% year after year (39% year-over-year at $1.46B last quarter).

Gross margin over 60%, and operating margin over 35%.

Producing significant free cash flow ($423M last quarter).

GAAP profitable ($492M net income last quarter).

Consistently achieving a return on invested capital over 20%.

Consistently growing GAAP EPS with no dilution.

If I commit to this position, my plan is to continue learning about the company and gradually increase my involvement over time.

I look at Arista Networks as “under-the-radar-mini-Nvidia”. And while there are the usual risks associated with any company, the real risk lies in patience, as the company's performance may be inconsistent at times. To me, this is a decade-investment.

Evolution Gaming Group – EVO.ST

I’ve found a company that I believe will do well for decades to come: Evolution Gaming AB.

This Sweden-based company is the leading provider of live casino games for online gambling websites. They use actual casino equipment and real dealers to broadcast games such as roulette, blackjack, and poker over the internet, allowing people to have a genuine casino experience from their homes. It's important to note that they do not offer their services directly to consumers, which mitigates potential obstacles and risks.

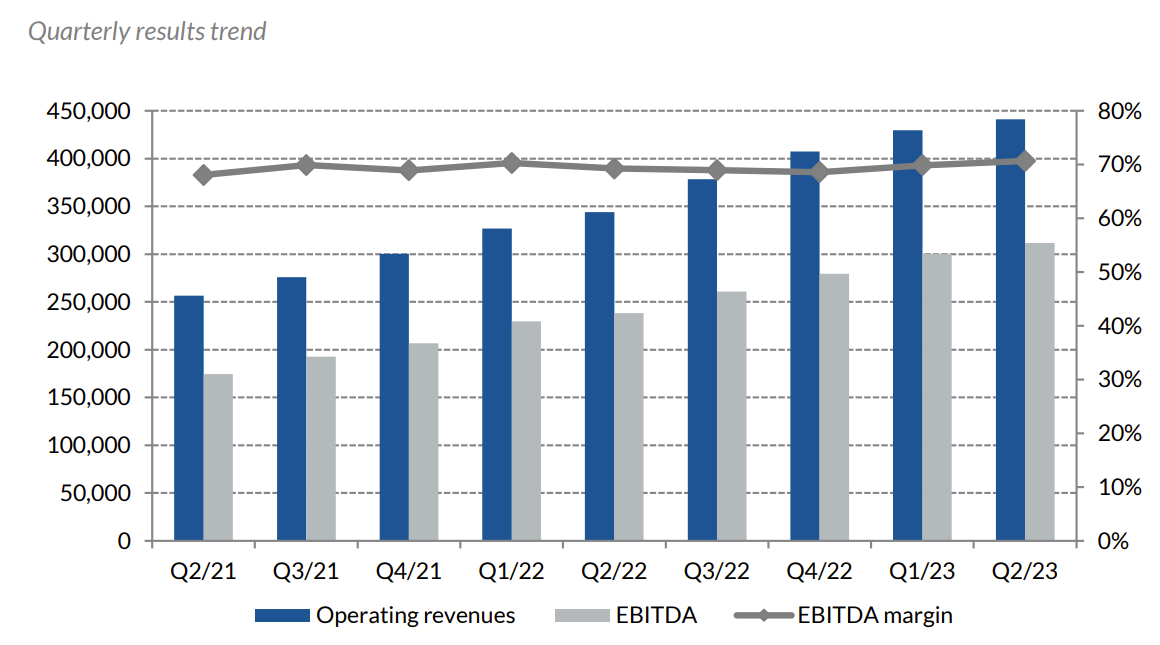

The company's underlying business fundamentals are impressive: they have a YoY revenue growth rate of 28%, €441M in revenue, an EBITDA margin of ~70% (no typo!), an FCF margin of over 50%, an operating margin of 64%, a consistent Return on Invested Capital above 20%, about $500M in cash and no debt. Almost all meaningful metrics are moving in the right direction, and there has been no dilution for a while now. I cannot recall seeing such a strong performance across the board.

Last week, Evolution Gaming AB reached another all-time high with its average active player count at 60k players versus 19k last year, and it is likely to grow to 100k soon. I appreciate their leadership team and their business strategy.

The company's total addressable market is vast since most casino games are still being played in retail casinos, but the shift to online gambling is rapidly accelerating.

Of course, there are regulatory and other typical business risks, and lately, they have struggled because of the tough macro environment. However, as of now, I believe that there is a bright future ahead for the company.

No activities:

Monday – MNDY 0.00%↑

Money reported one of the strongest earnings:

Record free cash flow

Strong new logo growth

Raised Full Year Guidance

Why does Monday keep delivering? I believe it's due to a) its great leadership and culture, which you can check out on Glassdoor, b) its customer-centric product strategy, and c) its rock-solid marketing engine, as I wrote about last year in this post.

There are no planned changes here, and I'm happy with the current allocation.

Closing Thoughts

I believe that we are at a turning point for accelerated cloud and software spending, as earnings indicate. If this is true, it aligns with the thoughts I wrote down in December of last year. It's almost like I had a crystal ball! (laughs)

Now that earnings season is almost over, there will finally be a break for the next three months. I have some great companies on my watchlist that I will be reviewing soon and may add to my portfolio. Stay tuned!

You can find all my previous portfolio reviews here.

Thank you for reading and Happy Investing!

Follow me on Twitter for frequent updates: @MoritzMDrews

Disclaimer: This portfolio summary is for informational purposes only and does not constitute investment advice. Everything expressed here is solely my personal opinion. As I am not a professional, please do not blindly follow my perspectives as they could lead to incorrect conclusions.

Hey Moritz,

Great write-up as always. The more time is passing the more i conclude that conviction is very, very important.

I was very calm and patient during the chaos of '22. Didn't sell, anything and kept what i had.

The problems came in '23. Seeing others in Saul's board jumping from company to company and getting ahead with they YTD results I started to think what to do. I sold DDOG, BILL, GTLB on their Q4 FY23 bad earnings...and then their Q1FY24 send the stocks up, up, up. Thus I was falling behind.

I am aware that I have to compete only with myself, It is unpleasant to see 15-30% difference from the others.

So, I guess my question is how you feel in these moments, does the anxiety brings its arms around you in an iron hug and how you deal with that?

Do you read your notes for a company, before selling it and this helps you sustain your conviction?

Thanks in advance for taking time to read my chaotic questions.

Interesting, although I can still see little change. You write that your biggest loss was -64%, but the wikifolio shows -74% https://www.wikifolio.com/de/at/w/wfopfmetfs?src=search_top&searchTerm=MORITZ%20DREWS#keyfigures

You really need a strong stomach and a lot of great slogans. You have only really held a few stocks. You bought a lot back at a high price and it has nothing to do with conviction.

I find your new approach very interesting: "This means that my primary focus is investing in the people, the leadership, and the culture behind great companies.

I was even more surprised when I saw that you invest in the biggest live casino operator. Yes, nice value at the moment, which you never had in your portfolio before, but "leadership" and "culture"? I don't want to put ethical investing up for discussion, but anyone who bets on "leadership" and "culture" and buys Evolution should define these points very precisely and question them. In times when money is scarce, even more money is gambled away in the hope of hitting the jackpot. Somewhat similar to your whole process in recent years.

Don't take it amiss. You will probably think of your Growth Mindset that you mentioned here https://www.happyinvesting.pro/p/underperformance-dein-ego-gegen-den-index