Every month quarter I’ll provide updates on my stock portfolio to share my investment philosophy, current holdings, and foster mutual learning.

For more frequent updates and my expectations for the next earnings season, follow me on Twitter: @MoritzMDrews

Let's dive in!

In my previous portfolio review, I discussed the evolution of my investing philosophy, which now places a stronger emphasis on the long-term prospects of a business rather than focusing solely on quarterly metrics that can be volatile.

In theory, I have always had a mindset of "holding forever" when it comes to investing. However, in practice, this approach can be risky, especially when investing solely in fast-growing, unprofitable (GAAP), and highly-priced businesses operating in competitive and disruptive industries, with the hope of also weathering difficult times.

While some companies, like Crowdstrike CRWD 0.00%↑ , have become profitable on a GAAP basis, it remains to be seen if they can sustain profitability over the long term and if they have a sustainable competitive advantage. On the other hand, companies like Snowflake SNOW 0.00%↑ have yet to achieve profitability while maintaining one of the highest valuations in the market.

When I use the term "risky," I am not referring to the possibility of losing all of the capital. Instead, I am referring to the expectation of generating returns that outperform the market.

Let's be realistic: We invest in individual stocks because we believe we can outperform the market. However, I don't believe it’s possible to consistently outperform the market over the long term by investing in a small number of these expensive businesses with lots of uncertainty mentioned above.

Historical data has shown that most businesses do not succeed. Therefore, when investing in companies like Monday MNDY 0.00%↑, Bill BILL 0.00%↑, or Crowdstrike CRWD 0.00%↑ (just randomly selected names from my portfolio), it’s important to be cautious about expecting market-beating performance over the next decade.

Grasping the true difference between growth and value took me some time. It's not an either-or situation. A business needs to provide value to its shareholders, and the growth of key metrics such as revenue and earnings contributes to that value. Successful investors aim for both.

However, there is a third aspect, often mistaken as "value," which refers to the price (not stock price, but the multiple) of the company. Considering this price becomes crucial when considering long-term investments in such companies.

The main difference between growth and value investors lies in the timing of their entry and exit from a stock. Growth investors typically enter when growth is accelerating, often regardless of valuation, and exit when growth begins to decelerate, as valuation becomes a significant factor. On the other hand, value investors buy stocks at low valuations and sell when the investment becomes overvalued (price).

Personally, I’m not a fan of either style anymore. Both styles require constant action, including:

They’re forced to continuously seek new opportunities, as current holdings may fall out of favor over time due to either decelerating growth or high valuation (which can be stressful).

Selling stocks and paying taxes (can hinder compounding).

Buying new stocks with the hope of achieving better performance than the previous investment (moreover, the paid taxes must be compensated by a significant stock price appreciation in the new investment).

Now, I'm not saying these styles are wrong. There are many investors who have achieved impressive results using them. It's just my personal preference:

I wouldn't say I like the feeling of constantly being compelled to take action either because growth is slowing down (which is bound to happen at some point due to the law of large numbers) or because valuation has become unreasonable.

So, what does all of this mean?

As I mentioned in my last portfolio review, my main focus is on the long-term, sustainable growth of the business. I'm willing to hold onto investments through both ups and downs. Here’s an example of my most recent addition, Evolution Gaming ($EVO.ST / $EVVTY ):

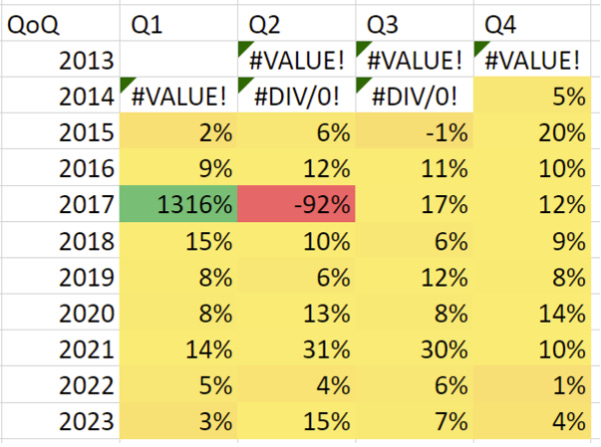

The quarterly revenue growth of this company has been decelerating for quite some time, making it less appealing to investors who solely prioritize growth:

Year-over-year (YoY) revenue growth appears lumpy:

However, when taking a step back and looking at it from a long-term perspective, the overall trend of absolute revenues appears to be very healthy:

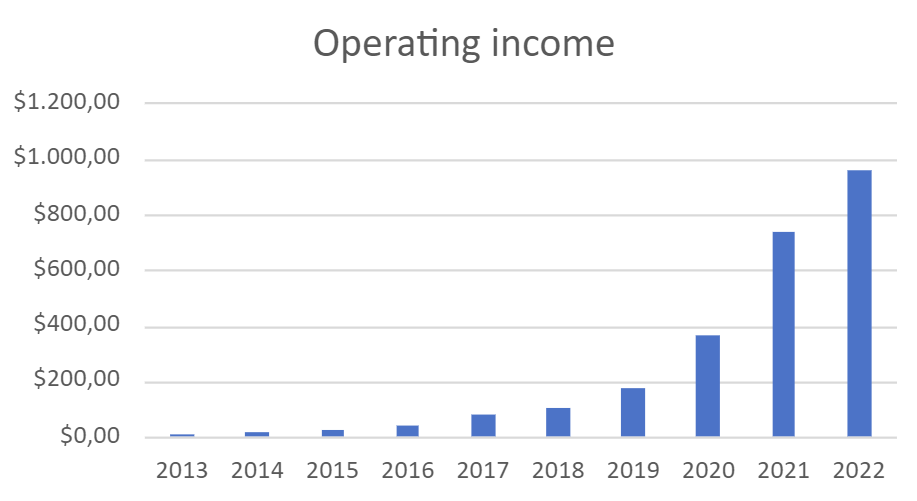

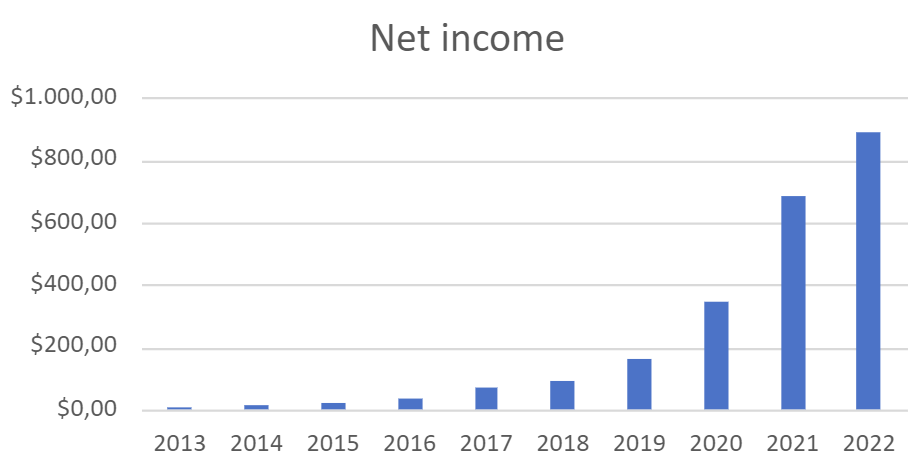

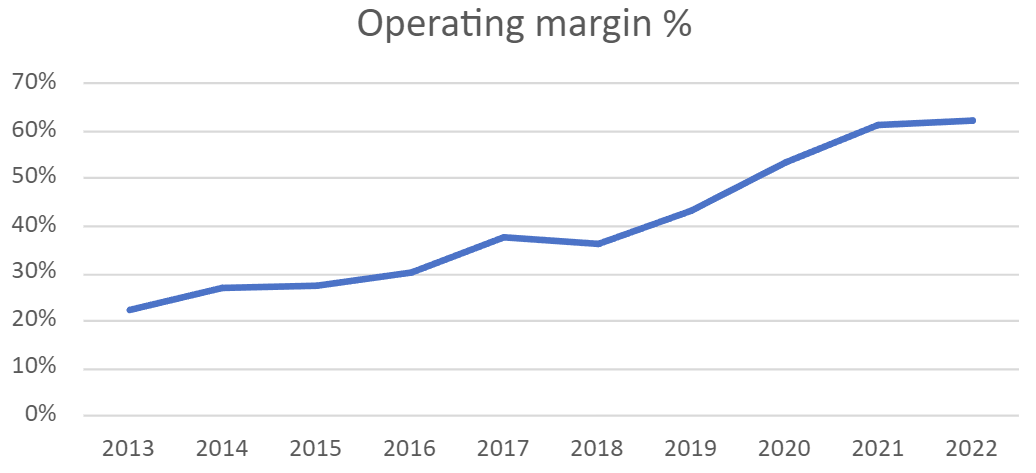

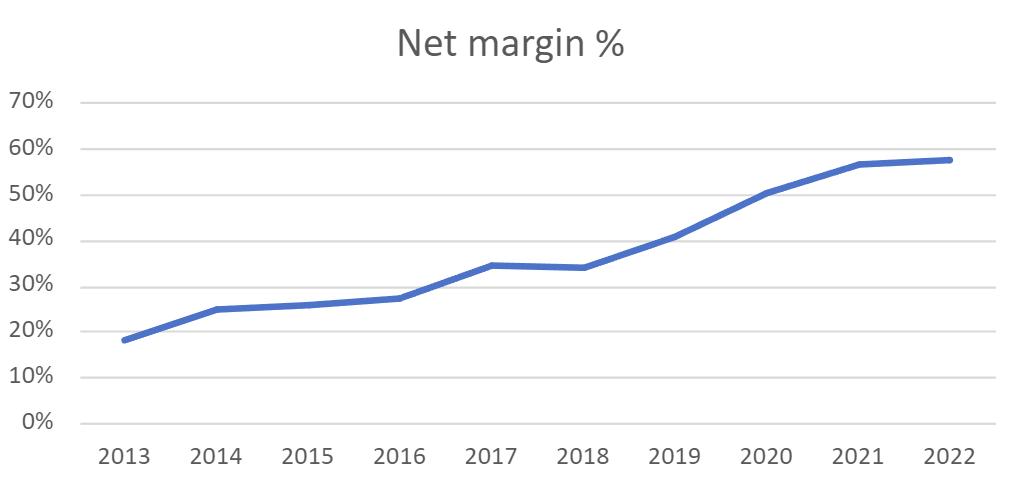

Profitability is skyrocketing:

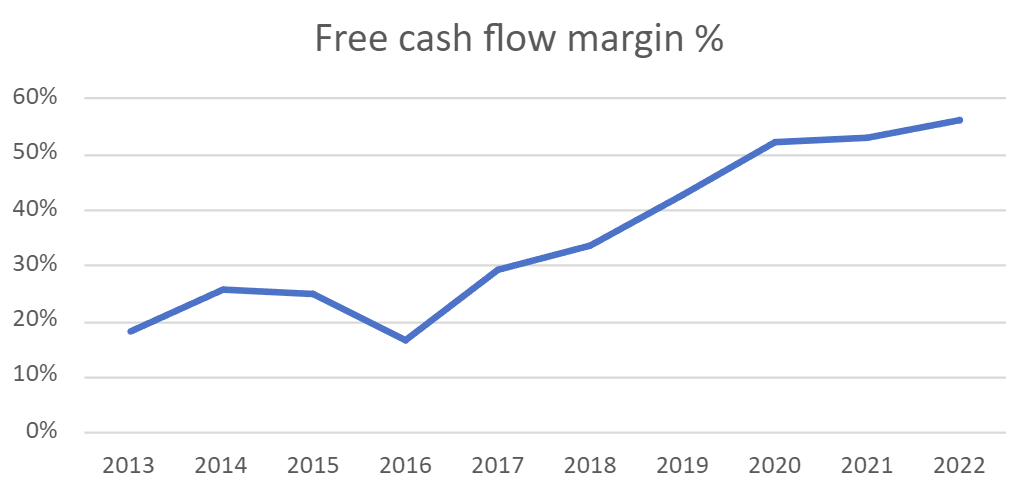

Lots of free cash flow:

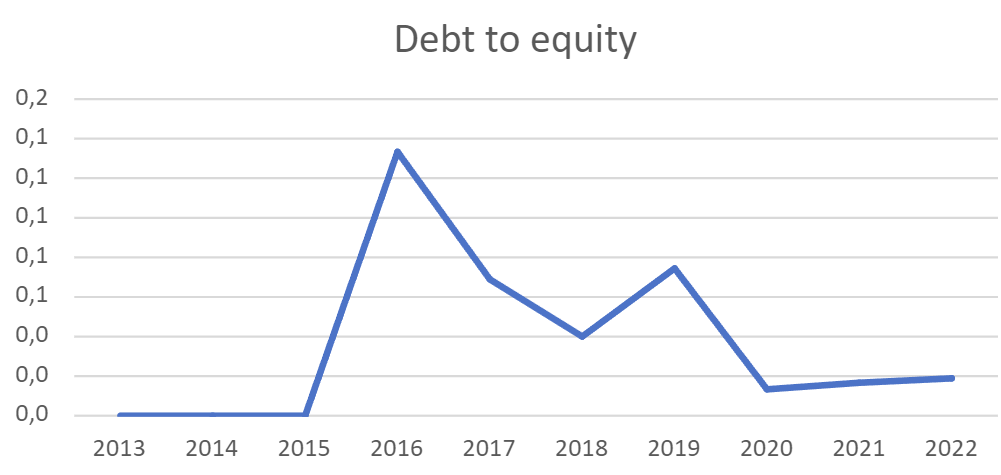

No debt:

Unprecedented margins continue to trend upward:

Earnings per share continue to trend upward:

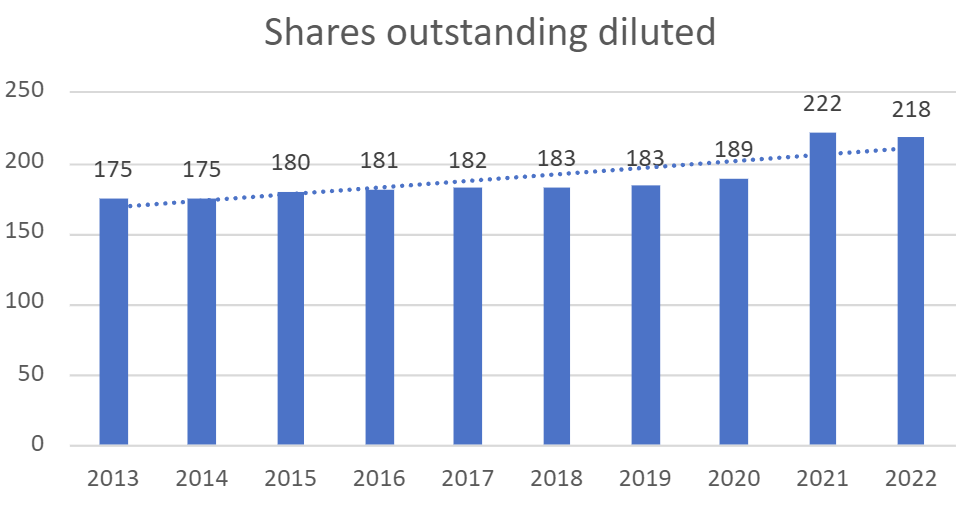

And dilution remains very stable (In 2021, it was primarily driven through acquisitions):

While most mentioned looks impressive, the market does not seem to agree. The stock price of Evolution Gaming has been moving sideways for nearly 2 years, and its P/E ratio is at a historically low level of just 23.

After extensive research on Evolution Gaming, I’ve concluded that it is a misunderstood business, rather than being simply seen as a gambling stock with no competitive advantage and unethical practices.

I firmly believe that Evolution Gaming, as the B2B market leader in live casinos, will continue to demonstrate sustainable growth of 20% or more in the coming years due to a) the expanding live casino market, b) their international expansion efforts, and c) diversifying revenue streams through options like RNG.

If they continue to execute their plans, as they have in the past, the market will eventually catch up and deliver consistent returns to shareholders. Additionally, the company's valuation appears reasonable and not excessively priced.

Here’s a recent article that provides an in-depth analysis of Evolution's competitive advantage and the factors driving its success (but also highlights risks that are important to understand). I found it informative and enjoyable to read.

So here we have a highly profitable business that is experiencing sustainable growth across multiple aspects in a growing market, driven by capable management who have skin in the game.

This is the type of business I am willing to hold onto, even during challenging quarters, as long as the investment thesis continues to prove successful.

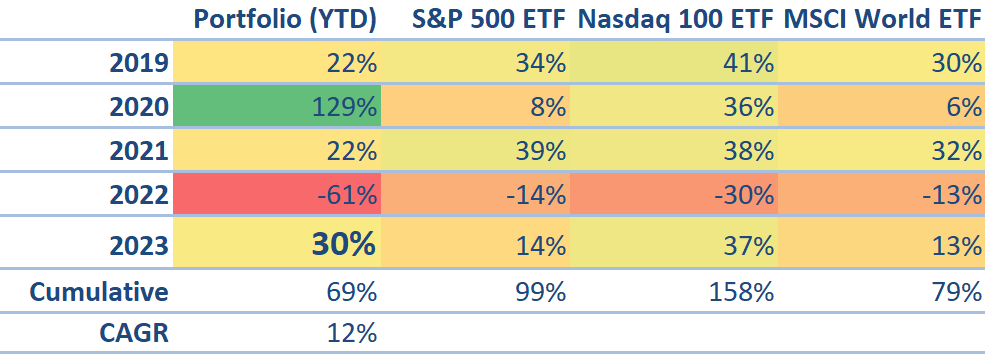

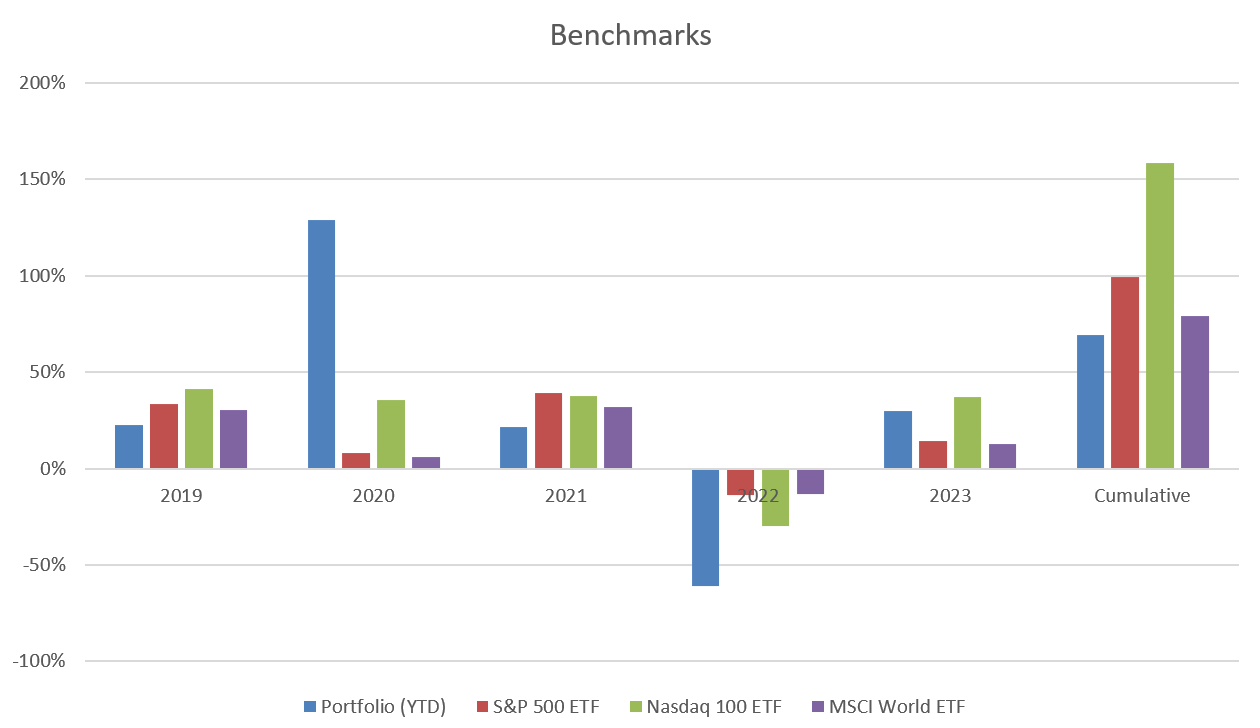

Portfolio performance

Timestamp: 9/30/2023

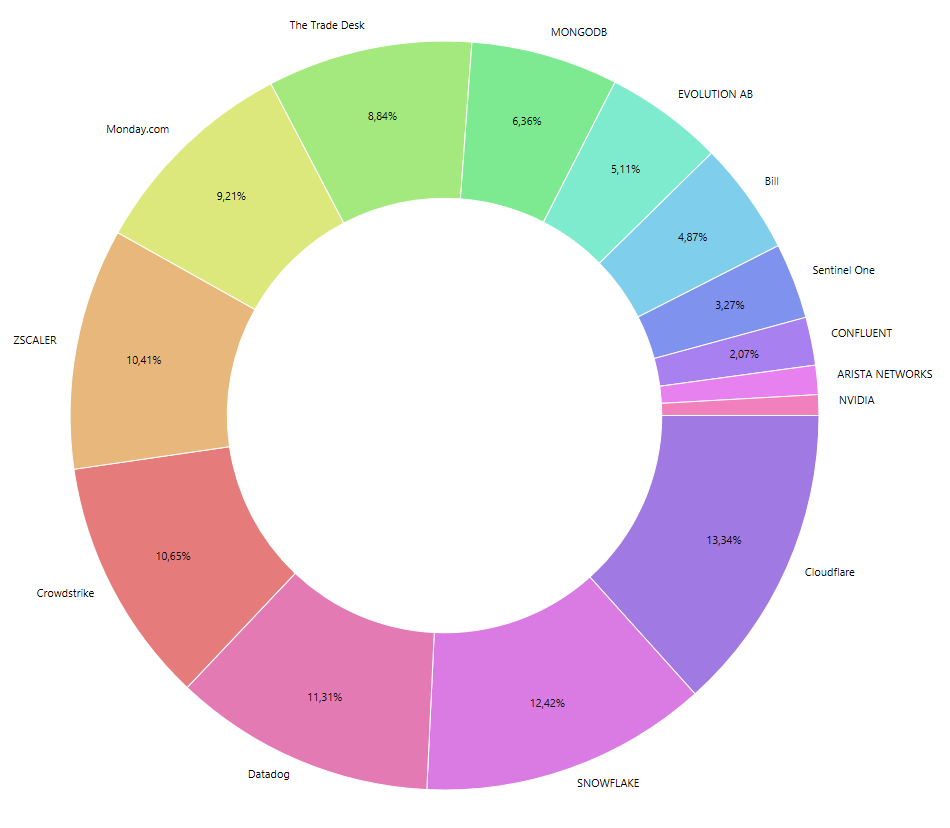

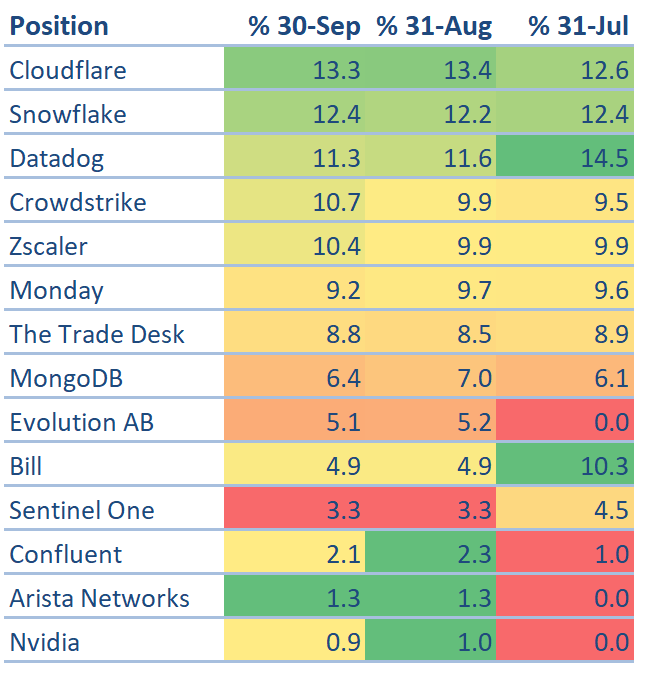

Portfolio allocations

Closing Thoughts

As mentioned in my recent write-ups, I intend to make fewer adjustments to my portfolio. Consequently, there will be fewer portfolio changes to report, like in September when I didn’t change anything.

Going forward, I’ll publish a quarterly portfolio review every 3 months that will include the usual updates on performance, changes, and thoughts. As a result, this will be my final monthly portfolio review.

The next portfolio review will be published in the first week of January 2024. I expect it to feature a few new exciting and sustainable businesses, similar to Evolution Gaming. Stay tuned!

Thank you for reading and Happy Investing!

Follow on X/Twitter for frequent updates: @MoritzMDrews

Read my previous portfolio reviews here.

Disclaimer: This portfolio summary is for informational purposes only and does not constitute investment advice. Everything expressed here is solely my personal opinion. As I am not a professional, please do not blindly follow my perspectives as they could lead to incorrect conclusions.

Hi Moritz,

Will miss your monthly updates for sure, but hopefully you will continue sharing your thought between the quarters.

Reading your X tread thread about Arista Network and their Q3 earnings, which just were announced, I started wondering why Arsita's stock is performing YTD better, than ZScaller or have the same YTD performance with Crowdstrike?! Arista is hardware/cyclical business, lower gross margins and slower growth compared to the other two.

Interested in your opinion on that.

Thanks,

Martin

It took you a long time, but slowly you seem to have realized that valuation does matter and that moon prices will not generate excess returns for years despite growth. Until now you were a momentum trader. In and out. A lot of money was gambled away.

That you buy EVO shows that you have become more valuation conscious. I'm sure EVO will give you a great return as long as there are no regulatory headwinds. Whether or not you have to play along with that remains to be seen. In crises like these, EVO will benefit even more. Desperate people hoping for their luck to save their house and yard. But in the end, they gamble everything away. Well.

You mention how expensive SNOW and CRWD are, but are not willing to adjust anything. So you just hope that the high valuation will disappear into thin air?